Quest Diagnostics 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.F- 44

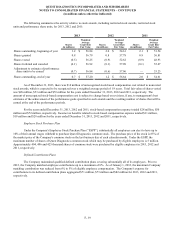

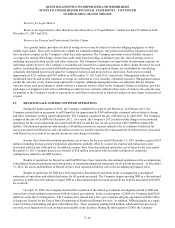

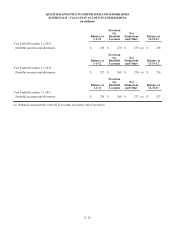

Reserves for Legal Matters

Reserves for legal matters, other than those described above in "Legal Matters", totaled less than $5 million at both

December 31, 2013 and 2012.

Reserves for General and Professional Liability Claims

As a general matter, providers of clinical testing services may be subject to lawsuits alleging negligence or other

similar legal claims. These suits could involve claims for substantial damages. Any professional liability litigation could also

have an adverse impact on the Company's client base and reputation. The Company maintains various liability insurance

coverages for, among other things, claims that could result from providing, or failing to provide, clinical testing services,

including inaccurate testing results, and other exposures. The Company's insurance coverage limits its maximum exposure on

individual claims; however, the Company is essentially self-insured for a significant portion of these claims. Reserves for such

matters, including those associated with both asserted and incurred but not reported claims, are established by considering

actuarially determined losses based upon the Company's historical and projected loss experience. Such reserves totaled

approximately $121 million and $110 million as of December 31, 2013 and 2012, respectively. Management believes that

established reserves and present insurance coverage are sufficient to cover currently estimated exposures. Management cannot

predict the outcome of any claims made against the Company. Although management does not anticipate that the ultimate

outcome of any such proceedings or claims will have a material adverse effect on the Company's financial condition, given the

high degree of judgment involved in establishing accruals for loss estimates related to these types of matters, the outcome may

be material to the Company's results of operations or cash flows in the period in which the impact of such claims is determined

or paid.

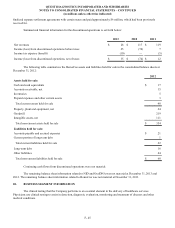

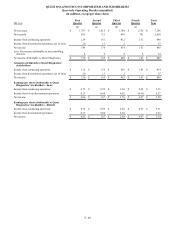

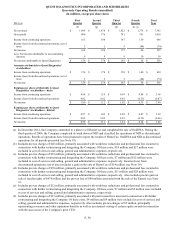

19. HELD FOR SALE AND DISCONTINUED OPERATIONS

During the fourth quarter of 2012, the Company committed to a plan to sell HemoCue. In February 2013, the

Company entered into an agreement to sell HemoCue for approximately $300 million plus estimated cash on hand at closing

and other customary working capital adjustments. The Company completed the sale of HemoCue in April 2013. The Company

completed the sale of OralDNA in December 2012. As a result, the Company's 2012 results include charges in discontinued

operations for the asset impairment associated with HemoCue and the loss on sale associated with OralDNA totaling $86

million. Discontinued operations also includes a $8 million income tax expense related to the re-valuation of deferred tax

assets associated with HemoCue and a $4 million income tax benefit related to the remeasurement of deferred taxes associated

with HemoCue as a result of an enacted income tax rate change in Sweden.

Income (loss) from discontinued operations, net of taxes for the year ended December 31, 2013 includes a gain of $14

million (including foreign currency translation adjustments, partially offset by income tax expense and transaction costs)

associated with the sale of HemoCue. In addition, income (loss) from discontinued operations, net of taxes for the year ended

December 31, 2013, includes discrete tax benefits of $20 million associated with favorable resolution of certain tax

contingencies related to our NID business.

Results of operations for HemoCue and OralDNA have been reported as discontinued operations in the accompanying

consolidated financial statements and related notes to consolidated financial statements for all periods presented. At December

31, 2012, the assets and liabilities of HemoCue have been reported as held for sale in the accompanying balance sheet.

Results of operations for NID have been reported as discontinued operations in the accompanying consolidated

statements of operations and related disclosures for all periods presented. The Company began reporting NID as a discontinued

operation in 2006 and will continue to report NID as a discontinued operation until uncertain tax benefits associated with NID

are resolved.

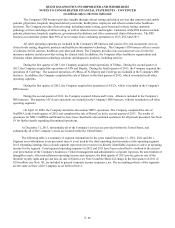

On April 15, 2009, the Company finalized the resolution of the federal government investigation related to NID and

entered into a final settlement agreement with the federal government. In the second quarter of 2009, the Company paid $268

million to settle the civil allegations. The Company also entered into a five-year corporate integrity agreement with the Office

of Inspector General for the United States Department of Health and Human Services. In addition, NID pled guilty to a single

count of felony misbranding and paid a $40 million fine. These payments totaling $308 million, which had been previously

reserved, were funded out of cash on-hand and available credit facilities. During the third quarter of 2009, the Company

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)