Quest Diagnostics 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

57

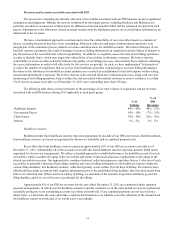

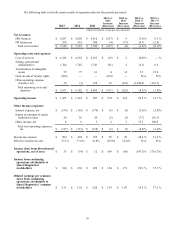

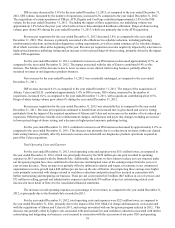

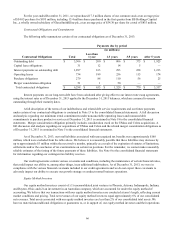

The following table sets forth certain results of continuing operations data as a percentage of net revenues for the

periods presented:

2013 2012 2011

Net revenues:

DIS business 92.2% 92.4% 92.2%

DS businesses 7.8% 7.6% 7.8%

Total net revenues 100.0% 100.0% 100.0%

Operating costs and expenses:

Cost of services 60.5% 59.1% 59.0%

Selling, general and administrative 23.8 23.6 23.6

Amortization of intangible assets 1.1 1.0 0.8

Gain on sale of royalty rights (6.6)— —

Other operating expense (income), net 0.6 — 3.2

Total operating costs and expenses 79.4% 83.7% 86.6%

Operating income 20.6% 16.3% 13.4%

Total non-operating expenses, net 1.8% 1.8% 1.9%

Income tax expense 7.0% 5.4% 4.8%

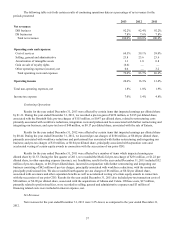

Continuing Operations

Results for the year ended December 31, 2013 were affected by certain items that impacted earnings per diluted share

by $1.31. During the year ended December 31, 2013, we recorded a pre-tax gain of $474 million, or $1.95 per diluted share,

associated with the Ibrutinib Sale; pre-tax charges of $115 million, or $0.47 per diluted share, related to restructuring costs

primarily associated with workforce reductions, integration costs and professional fees associated with further restructuring and

integrating our business; and a pre-tax loss of $40 million, or $0.17 per diluted share, associated with the sale of Enterix.

Results for the year ended December 31, 2012 were affected by certain items that impacted earnings per diluted share

by $0.44. During the year ended December 31, 2012, we incurred pre-tax charges of $106 million, or $0.40 per diluted share,

primarily associated with workforce reductions and professional fees associated with further restructuring and integrating our

business; and pre-tax charges of $10 million, or $0.04 per diluted share, principally associated with separation costs and

accelerated vesting of certain equity awards in connection with the succession of our prior CEO.

Results for the year ended December 31, 2011 were affected by a number of items which impacted earnings per

diluted share by $1.53. During the first quarter of 2011, we recorded the Medi-Cal pre-tax charge of $236 million, or $1.22 per

diluted share, in other operating expense (income), net. In addition, results for the year ended December 31, 2011 included $52

million of pre-tax charges, or $0.20 per diluted share, incurred in conjunction with further restructuring and integrating our

business consisting of $42 million of pre-tax charges, principally associated with workforce reductions, with the remainder

principally professional fees. We also recorded fourth quarter pre-tax charges of $6 million, or $0.02 per diluted share,

associated with severance and other separation benefits as well as accelerated vesting of certain equity awards in connection

with the succession of our prior CEO. Results for the year ended December 31, 2011 also included pre-tax transaction costs of

$20 million, or $0.09 per diluted share, associated with the acquisitions of Athena and Celera. Of these costs, $17 million,

primarily related to professional fees, were recorded in selling, general and administrative expenses and $3 million of

financing related costs were included in interest expense, net.

Net Revenues

Net revenues for the year ended December 31, 2013 were 3.2% lower, as compared to the year ended December 31,

2012.