Quest Diagnostics 2011 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2011 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

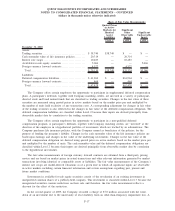

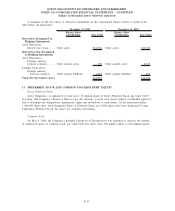

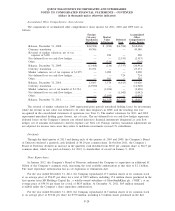

A summary of the fair values of derivative instruments in the consolidated balance sheets is stated in the

table below (in thousands):

Balance Sheet

Classification Fair Value

Balance Sheet

Classification Fair Value

December 31, 2011 December 31, 2010

Derivatives Designated as

Hedging Instruments

Asset Derivatives:

Interest rate swaps . .... Other assets $56,520 Other assets $10,483

Derivatives Not Designated

as Hedging Instruments

Asset Derivatives:

Foreign currency

forward contracts. . . .... Other current assets 180 Other current assets 4,527

Liability Derivatives:

Foreign currency

forward contracts .... Other current liabilities 1,648 Other current liabilities 464

Total Net Derivatives Asset $55,052 $14,546

13. PREFERRED STOCK AND COMMON STOCKHOLDERS’ EQUITY

Series Preferred Stock

Quest Diagnostics is authorized to issue up to 10 million shares of Series Preferred Stock, par value $1.00

per share. The Company’s Board of Directors has the authority to issue such shares without stockholder approval

and to determine the designations, preferences, rights and restrictions of such shares. Of the authorized shares,

1,300,000 shares have been designated Series A Preferred Stock and 1,000 shares have been designated Voting

Cumulative Preferred Stock. No shares are currently outstanding.

Common Stock

On May 4, 2006, the Company’s Restated Certificate of Incorporation was amended to increase the number

of authorized shares of common stock, par value $0.01 per share, from 300 million shares to 600 million shares.

F-27

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)