Quest Diagnostics 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

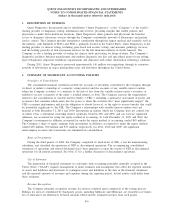

In June 2011, the FASB issued an amendment to the accounting standards related to the presentation of

comprehensive income. This standard revises the manner in which entities present comprehensive income in their

financial statements and removes the option to present items of other comprehensive income in the statement of

changes in stockholders’ equity. This standard requires an entity to report components of comprehensive income

in either (1) a continuous statement of comprehensive income or (2) two separate but consecutive statements of

net income and other comprehensive income. In December 2011, the FASB issued further amendments to this

standard to defer the requirement for entities to present reclassification adjustments out of accumulated other

comprehensive income (loss) on the face of the income statement. These standards will become effective

retrospectively on January 1, 2012. The Company expects to present comprehensive income in two separate but

consecutive statements of net income and other comprehensive income.

In September 2011, the FASB issued an amendment to the accounting standards related to the testing of

goodwill for impairment. Under the revised guidance, an entity has the option to perform a qualitative assessment

of whether it is more-likely-than-not that a reporting unit’s fair value is less than its carrying value prior to

performing the two-step quantitative goodwill impairment test. If, based on the qualitative factors, an entity

determines that the fair value of the reporting unit is greater than its carrying amount, then the entity would not

be required to perform the two-step quantitative impairment test for that reporting unit. However, if the

qualitative assessment indicates that it is not more-likely-than-not that the reporting unit’s fair value exceeds its

carrying value, then the quantitative assessment must be performed. An entity is permitted to perform the

qualitative assessment on none, some or all of its reporting units and may also elect to bypass the qualitative

assessment and begin with the quantitative assessment of goodwill impairment. This amendment is effective for

the Company for annual and interim goodwill impairment tests performed on or after January 1, 2012 and is not

expected to have a material impact on the Company’s consolidated financial statements.

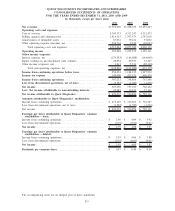

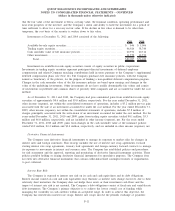

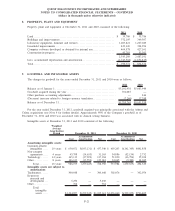

3. EARNINGS PER SHARE

The computation of basic and diluted earnings per common share was as follows (in thousands, except per

share data):

2011 2010 2009

Amounts attributable to Quest Diagnostics’ stockholders:

Income from continuing operations ................................. $472,149 $722,681 $730,347

Loss from discontinued operations, net of taxes . . ................... (1,582) (1,787) (1,236)

Net income available to Quest Diagnostics’ common stockholders. . . . $470,567 $720,894 $729,111

Income from continuing operations ................................. $472,149 $722,681 $730,347

Less: Earnings allocated to participating securities................... 2,961 3,355 2,223

Earnings available to Quest Diagnostics’ common stockholders –

basic and diluted . ............................................... $469,188 $719,326 $728,124

Weighted average common shares outstanding – basic ............... 158,672 175,684 185,948

Effect of dilutive securities:

Stock options and performance share units .......................... 1,500 1,636 1,850

Weighted average common shares outstanding – diluted . . . .......... 160,172 177,320 187,798

Earnings per share attributable to Quest Diagnostics’ common

stockholders – basic:

Income from continuing operations ................................. $ 2.96 $ 4.09 $ 3.92

Loss from discontinued operations .................................. (0.01) (0.01) (0.01)

Net income ....................................................... $ 2.95 $ 4.08 $ 3.91

Earnings per share attributable to Quest Diagnostics’ common

stockholders – diluted:

Income from continuing operations ................................. $ 2.93 $ 4.06 $ 3.88

Loss from discontinued operations .................................. (0.01) (0.01) (0.01)

Net income ....................................................... $ 2.92 $ 4.05 $ 3.87

F-13

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)