Quest Diagnostics 2011 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2011 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Operating income for the year ended December 31, 2010 decreased as a percentage of net revenues from the

prior year, primarily as a result of the impact of lower revenues in our clinical testing business, including the

estimated impact of severe weather in the first quarter of 2010, charges associated with workforce reductions and

employment litigation, partially offset by actions taken to adjust our cost structure, reduced cost of performance-

based compensation, improved experience associated with professional liability claims and lower bad debt

expense. The estimated impact of severe weather in the first quarter of 2010, combined with charges associated

with actions we took to adjust our cost structure, and the settlement of employment litigation, adversely impacted

the year-over-year change in operating income as a percentage of net revenues by 0.7% compared to the prior

year. In addition, the year-over-year change in operating income as a percentage of net revenues was also

adversely impacted by 0.2% associated with a $15.5 million gain recorded in 2009 related to an insurance

settlement for storm-related losses.

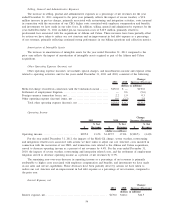

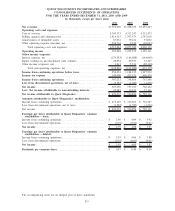

Interest Expense, net

2010 2009

Change:

Increase (Decrease)

(dollars in millions)

Interest expense, net. ................................................... $146.1 $144.1 $2.0

Interest expense, net for the year ended December 31, 2010 increased from the prior year primarily due to

higher average outstanding debt in 2010 compared to the prior year.

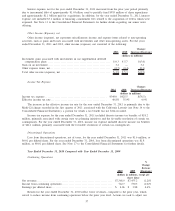

Other Income (Expense), net

Other income (expense), net represents miscellaneous income and expense items related to non-operating

activities, such as gains and losses associated with investments and other non-operating assets, and losses on the

early extinguishment of debt. For the years ended December 31, 2010 and 2009, other income (expense), net

consisted of the following:

2010 2009

Change:

Increase (Decrease)

(dollars in millions)

Investment gains associated with investments in our supplemental deferred

compensation plans .................................................... $ 5.7 $ 8.4 $(2.7)

Write-down of an investment ............................................. — (7.0) 7.0

Loss on early extinguishment of debt . .................................... — (20.4) 20.4

Other expense items, net ................................................. (0.4) (1.3) 0.9

Total other income (expense), net ......................................... $ 5.3 $(20.3) $25.6

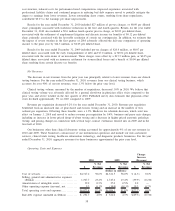

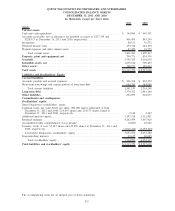

Income Tax Expense

2010 2009

Change:

Increase (Decrease)

(dollars in millions)

Income tax expense . ................................................... $425.5 $460.5 $(35.0)

Effective income tax rate ............................................... 35.9% 37.5% (1.6)%

The decrease in income tax expense for the year ended December 31, 2010 compared to the prior year was

primarily due to a reduction in income from continuing operations before income taxes of $43.6 million and a

decrease in the effective income tax rate. The effective income tax rate for the year ended December 31, 2010

decreased compared to the prior year primarily due to the favorable resolution of certain tax contingencies.

Results for the year ended December 31, 2010 included $22.1 million of income tax benefits, primarily associated

with the favorable resolution of certain tax contingencies. Results for the year ended December 31, 2009 included

$7.0 million of income tax benefits, primarily associated with certain discrete tax benefits.

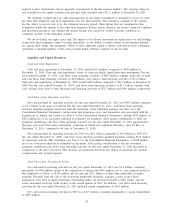

Discontinued Operations

Loss from discontinued operations, net of taxes, for the year ended December 31, 2010 was $1.8 million, or

$0.01 per diluted share, compared to $1.2 million, or $0.01 per diluted share, in 2009. On April 15, 2009, the

Company entered into a final settlement agreement with the federal government regarding NID and paid $308

60