Quest Diagnostics 2011 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2011 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

Overview

Our Company

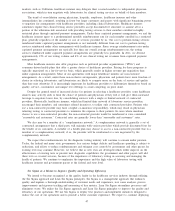

Quest Diagnostics is the world’s leading provider of diagnostic testing, information and services, providing

insights that enable patients and physicians to make better healthcare decisions. Quest Diagnostics, with a leading

position in most of its domestic geographic markets and service offerings, is well positioned to benefit from the

long-term growth expected in the industry. Over 90% of our revenues are derived from clinical testing with the

balance derived from risk assessment services, clinical trials testing, diagnostic products and healthcare

information technology. Clinical testing is generally categorized as clinical laboratory testing and anatomic

pathology services. Clinical laboratory testing is generally performed on whole blood, serum, plasma and other

body fluids, such as urine, and specimens such as microbiology samples. Anatomic pathology services are

principally for the detection of cancer and are performed on tissues, such as biopsies, and other samples, such as

human cells. We are the leading cancer diagnostics testing provider focused on anatomic pathology and molecular

diagnostics, and provide interpretive consultation through the largest medical and scientific staff in the industry,

with hundreds of M.D.s and Ph.D.s, primarily located in the United States. In addition, we are the leading

provider of gene-based and esoteric testing, the leading provider of risk assessment services for the life insurance

industry in North America and a leading provider of testing for drugs-of-abuse in the United States. We are also

a leading provider of testing for clinical trials. Our diagnostics products business manufactures and markets

diagnostic test kits and specialized point-of-care testing. We also empower healthcare organizations and clinicians

with robust information technology solutions.

The Clinical Testing Industry

Clinical testing is an essential element in the delivery of healthcare services. Physicians use laboratory tests

to assist in the detection, diagnosis, evaluation, monitoring and treatment of diseases and other medical

conditions.

Most laboratory tests are performed by one of three types of laboratories: commercial clinical laboratories;

hospital-affiliated laboratories; or physician-office laboratories. In 2011, we estimate that hospital-affiliated

laboratories accounted for approximately 60% of the market, commercial clinical laboratories approximately one-

third and physician-office laboratories the balance.

Orders for laboratory testing are generated from physician offices, hospitals and employers and can be

affected by a number of factors. For example, changes in the United States economy can affect the number of

unemployed and uninsured, and design changes in healthcare plans can affect the number of physician office and

hospital visits, and can impact the utilization of laboratory testing.

The diagnostic testing industry is subject to seasonal fluctuations in operating results and cash flows.

Typically, testing volume declines during the summer months, year-end holiday periods and other major holidays,

reducing net revenues and operating cash flows below annual averages. Testing volume is also subject to declines

due to severe weather or other events, which can deter patients from having testing performed and which can

vary in duration and severity from year to year.

Key Trends

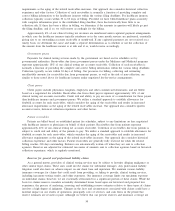

There are a number of key trends that we expect will have a significant impact on the clinical testing

business in the United States and on our business. In addition to the economic slow down in the United States

which we believe has temporarily reduced industry growth rates, these trends present both opportunities and risks.

However, because clinical testing is an essential healthcare service and because of certain of the key trends

discussed below, we believe that the clinical testing industry will continue to grow over the long term and that

we are well positioned to benefit from the long-term growth expected in the industry. The key trends that we

expect will have a significant impact on the clinical testing business include:

•the growing and aging population;

•continuing research and development in the areas of genomics (the study of DNA, genes and

chromosomes) and proteomics (the analysis of individual proteins and collections of proteins), which is

expected to yield new, more sophisticated and specialized diagnostic tests;

•increasing recognition by consumers and payers of the value of laboratory testing as a means to improve

health and reduce the overall cost of healthcare through early detection and prevention;

45