Quest Diagnostics 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

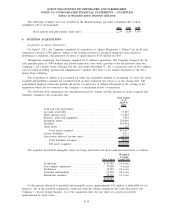

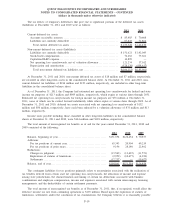

The acquired amortizable intangible assets are being amortized over their estimated useful lives as follows:

Fair Values

Weighted

Average

Useful Life

Outlicensed technology ......................... $46,450 6 years

Technology .................................... 21,730 8 years

Customer relationships.......................... 6,750 9 years

Tradename..................................... 5,400 5 years

$80,330

In addition to the amortizable intangible assets noted above, $5.5 million was allocated to in-process

research and development, which is currently not subject to amortization.

Of the amount allocated to goodwill and intangible assets, approximately $28 million is deductible for tax

purposes. Of the total goodwill acquired in connection with the Celera acquisition, approximately $104 million

has been allocated to the Company’s clinical testing business, with the remainder allocated to the Company’s

diagnostics products business. As of the acquisition date, the fair value of accounts receivable approximated its

book value.

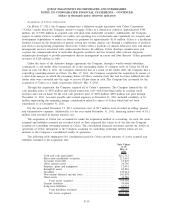

The goodwill recorded as part of the Athena and Celera acquisitions includes: the expected synergies

resulting from combining the operations of the acquired businesses with those of the Company; and the value

associated with an assembled workforce that has a historical track record of identifying opportunities, developing

services and products, and commercializing them.

Pro Forma Combined Financial Information

Supplemental pro forma combined financial information has not been presented as the combined impact of

the Athena and Celera acquisitions is not material to the Company’s consolidated financial statements.

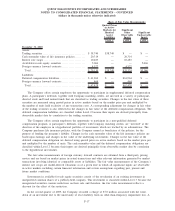

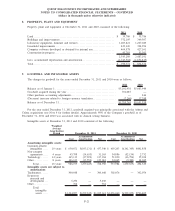

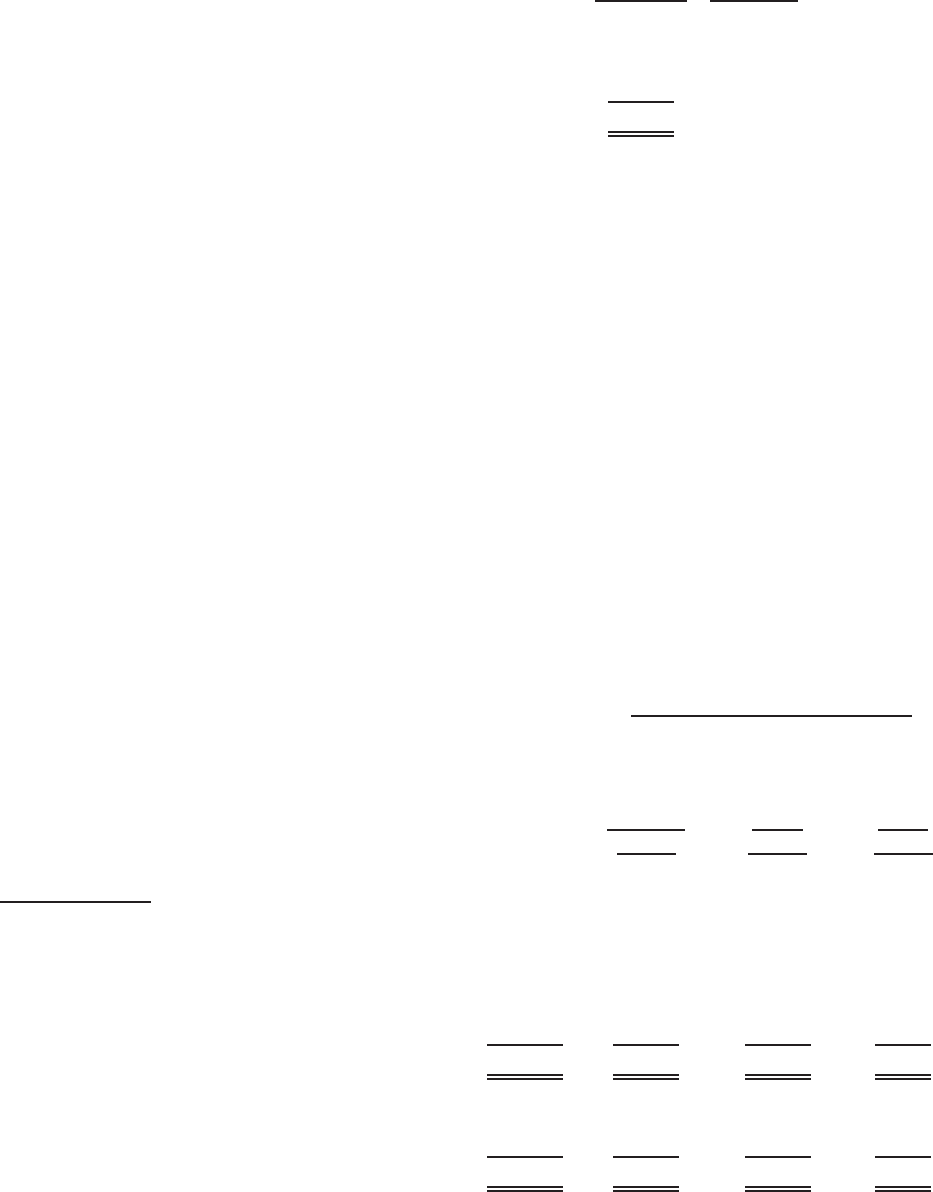

5. FAIR VALUE MEASUREMENTS

The following tables provide summaries of the recognized assets and liabilities that are measured at fair

value on a recurring basis:

Level 1 Level 2 Level 3

Quoted Prices

in Active

Markets for

Identical

Assets/

Liabilities

Significant

Other

Observable

Inputs

Significant

Unobservable

Inputs

Basis of Fair Value Measurements

December 31, 2011

Assets:

Interest rate swaps ................................... $ 56,520 $ — $56,520 $ —

Trading securities .................................... 46,926 46,926 — —

Cash surrender value of life insurance policies. ........ 20,936 — 20,936 —

Available-for-sale equity securities . . . ................. 646 — — 646

Foreign currency forward contracts. . . ................. 180 — 180 —

Total . ............................................. $125,208 $46,926 $77,636 $ 646

Liabilities:

Deferred compensation liabilities ...................... $ 71,688 $ — $71,688 $ —

Foreign currency forward contracts. . . ................. 1,648 — 1,648 —

Total . ............................................. $ 73,336 $ — $73,336 $ —

F-16

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)