Quest Diagnostics 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

available tax credits, net operating loss carryforwards and capitalized tax research and development expenditures

to reduce our future tax payments by approximately $110 million. Celera is a healthcare business focused on the

integration of genetic testing into routine clinical care through a combination of products and services

incorporating proprietary discoveries. Celera offers a portfolio of clinical laboratory tests and disease management

services associated with cardiovascular disease. In addition, Celera develops, manufactures and oversees the

commercialization of molecular diagnostic products, and has licensed other relevant diagnostic technologies

developed to provide personalized disease management in cancer and liver diseases. Celera generated revenues of

$128 million in 2010. We completed the acquisition of Celera on May 17, 2011 (see Note 4 to the Consolidated

Financial Statements for further details).

Results of Operations

Our clinical testing business currently represents our one reportable business segment. The clinical testing

business for each of the three years in the period ended December 31, 2011 accounted for more than 90% of net

revenues from continuing operations. Our other operating segments consist of our risk assessment services,

clinical trials testing, healthcare information technology and diagnostic products businesses. On April 19, 2006,

we decided to discontinue the operations of a test kit manufacturing subsidiary, NID. During the third quarter of

2006, we completed the wind down of NID. Therefore, the operations of NID are classified as discontinued

operations for all periods presented. Our business segment information is disclosed in Note 18 to the

Consolidated Financial Statements.

Settlement Related to the California Lawsuit

On May 9, 2011, we announced an agreement in principle to resolve a previously disclosed civil lawsuit

brought by a California competitor in which the State of California intervened (the “California Lawsuit”). In the

lawsuit, the plaintiffs alleged, among other things, that we overcharged Medi-Cal for testing services and violated

the California False Claims Act. Specifically, the plaintiffs alleged, among other things, that we violated certain

regulations that govern billing to Medi-Cal (“Comparable Charge” regulations). While denying liability, in order

to avoid the uncertainty, expense and risks of litigation, we agreed to resolve these matters for $241 million. On

May 19, 2011, we finalized a settlement agreement and release with the California Department of Health Care

Services, the California Attorney General’s Office and the qui tam relator. We agreed to the settlement to resolve

claims pertaining to the Comparable Charge allegations; we received a full release of these and all other

allegations in the complaint. We also agreed to certain reporting obligations regarding our pricing for a limited

time period and, at our option in lieu of such obligations for a transitional period, to provide Medi-Cal with a

discount (the “Transitional Discount”) until the end of July 2012. The Transitional Discount, to the extent

provided, is not expected to have a material impact on our consolidated revenues or results of operations.

As a result of the agreement in principle, we recorded a pre-tax charge to earnings in the first quarter of

2011 of $236 million (the “Medi-Cal charge”), or $1.22 per diluted share, which represented the cost to resolve

the matters noted above and related claims, less amounts previously reserved for related matters.

We funded the $241 million payment in the second quarter of 2011 with cash on hand and borrowings

under our existing credit facilities. See Note 16 to the Consolidated Financial Statements for further details.

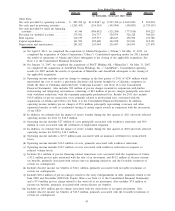

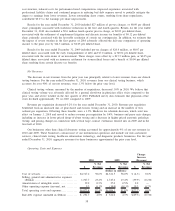

Year Ended December 31, 2011 Compared with Year Ended December 31, 2010

Continuing Operations

2011 2010

%

Change:

Increase

(Decrease)

(dollars in millions,

except per share data)

Net revenues................................................................ $7,510.5 $7,368.9 1.9%

Income from continuing operations........................................... 472.1 722.7 (34.7)%

Earnings per diluted share ................................................... $ 2.93 $ 4.06 (27.8)%

Results for the year ended December 31, 2011 were affected by a number of items which impacted earnings

per diluted share by $1.60. During the first quarter of 2011, we recorded the Medi-Cal charge of $236 million, or

$1.22 per diluted share, in other operating expense (income), net. In addition, results for the year ended

53