Quest Diagnostics 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

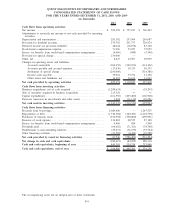

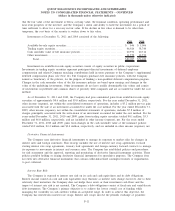

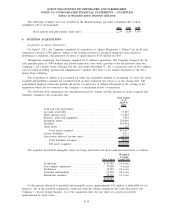

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2011, 2010 AND 2009

(in thousands)

2011 2010 2009

Cash flows from operating activities:

Net income . . . ....................................................... $ 505,650 $ 757,017 $ 766,222

Adjustments to reconcile net income to net cash provided by operating

activities:

Depreciation and amortization . . . ..................................... 281,102 253,964 256,687

Provision for doubtful accounts . . ..................................... 279,592 291,737 320,974

Deferred income tax provision (benefit) . . . ............................ 28,624 (18,878) 83,120

Stock-based compensation expense .................................... 71,906 53,927 75,059

Excess tax benefits from stock-based compensation arrangements ....... (4,466) (884) (5,540)

Provision for special charge .......................................... 236,000 — —

Other, net ........................................................... 8,627 22,967 29,699

Changes in operating assets and liabilities:

Accounts receivable ............................................. (306,652) (309,932) (314,102)

Accounts payable and accrued expenses .......................... (17,636) 18,235 56,533

Settlement of special charge ..................................... (241,000) — (314,386)

Income taxes payable ............................................ 39,062 33,732 21,190

Other assets and liabilities, net ................................... 14,665 16,162 21,962

Net cash provided by operating activities............................ 895,474 1,118,047 997,418

Cash flows from investing activities:

Business acquisitions, net of cash acquired ............................ (1,298,624) — (18,295)

Sale of securities acquired in business acquisition. . . ................... 213,541 ——

Capital expenditures.................................................. (161,556) (205,400) (166,928)

Decrease (increase) in investments and other assets . ................... 3,204 (11,110) (10,681)

Net cash used in investing activities ................................. (1,243,435) (216,510) (195,904)

Cash flows from financing activities:

Proceeds from borrowings ............................................ 2,689,406 — 1,245,525

Repayments of debt .................................................. (1,710,308) (169,491) (1,218,538)

Purchases of treasury stock ........................................... (934,994) (750,000) (499,991)

Exercise of stock options ............................................. 136,818 48,535 87,120

Excess tax benefits from stock-based compensation arrangements ....... 4,466 884 5,540

Dividends paid....................................................... (64,662) (71,321) (74,748)

Distributions to noncontrolling interests . . . ............................ (35,671) (36,739) (35,524)

Other financing activities ............................................. (21,509) (8,360) (30,588)

Net cash provided by (used in) financing activities .................. 63,546 (986,492) (521,204)

Net change in cash and cash equivalents ............................ (284,415) (84,955) 280,310

Cash and cash equivalents, beginning of year ....................... 449,301 534,256 253,946

Cash and cash equivalents, end of year ............................. $ 164,886 $ 449,301 $ 534,256

The accompanying notes are an integral part of these statements.

F-4