Quest Diagnostics 2011 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2011 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Share Repurchases

In January 2012, our Board of Directors authorized $1.0 billion of additional share repurchases of our

common stock, increasing our total available authorization at that time to $1.1 billion. The share repurchase

authorization has no set expiration or termination date.

For the year ended December 31, 2011, we repurchased 17.3 million shares of our common stock at an

average price of $54.05 per share for a total of $935 million, including 15.4 million shares purchased in the first

quarter from SB Holdings Capital Inc., a wholly-owned subsidiary of GlaxoSmithKline plc., at an average price

of $54.30 per share for a total of $835 million. At December 31, 2011, $65 million remained available under the

share repurchase authorization.

For the year ended December 31, 2010, we repurchased 14.7 million shares of our common stock at an

average price of $51.04 per share for $750 million, including 4.5 million shares purchased in the first quarter at

an average price of $56.21 per share for $251 million under an accelerated share repurchase transaction with a

bank.

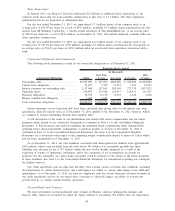

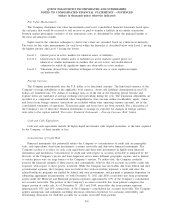

Contractual Obligations and Commitments

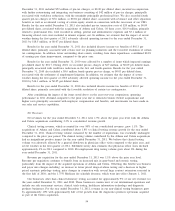

The following table summarizes certain of our contractual obligations as of December 31, 2011:

Contractual Obligations Total

Less than

1 year 1–3 years 3–5 years

After

5 years

(in thousands)

Payments due by period

Outstanding debt . . ............................ $3,945,000 $ 645,000 $200,000 $ 800,000 $2,300,000

Capital lease obligations ....................... 47,187 9,395 17,324 7,616 12,852

Interest payments on outstanding debt .......... 2,157,040 157,861 308,369 273,739 1,417,071

Operating leases. . . ............................ 638,507 174,496 228,593 118,851 116,567

Purchase obligations ........................... 69,758 31,178 31,932 4,420 2,228

Merger consideration obligation ................ 1,045 1,045 — — —

Total contractual obligations ................... $6,858,537 $1,018,975 $786,218 $1,204,626 $3,848,718

Interest payments on our long-term debt have been calculated after giving effect to our interest rate swap

agreements, using the interest rates as of December 31, 2011 applied to the December 31, 2011 balances, which

are assumed to remain outstanding through their maturity dates.

A full description of the terms of our indebtedness and related debt service requirements and our future

payments under certain of our contractual obligations is contained in Note 11 to the Consolidated Financial

Statements. A full discussion and analysis regarding our minimum rental commitments under noncancelable

operating leases and noncancelable commitments to purchase product or services at December 31, 2011 is

contained in Note 16 to the Consolidated Financial Statements. See Note 4 to the Consolidated Financial

Statements for a discussion with respect to the remaining merger consideration related to shares of Celera which

had not been surrendered as of December 31, 2011.

As of December 31, 2011, our total liabilities associated with unrecognized tax benefits were approximately

$195 million, which were excluded from the table above. We believe it is reasonably possible that these

liabilities may decrease by up to $17 million within the next twelve months, primarily as a result of the

expiration of statutes of limitations, settlements and/or the conclusion of tax examinations on certain tax

positions. For the remainder, we cannot make reasonably reliable estimates of the timing of the future payments

of these liabilities. See Note 6 to the Consolidated Financial Statements for information regarding our contingent

tax liability reserves.

Our credit agreements and our term loan due May 2012 contain various covenants and conditions, including

the maintenance of certain financial ratios, that could impact our ability to, among other things, incur additional

indebtedness. As of December 31, 2011, we were in compliance with the various financial covenants included in

our credit agreements and we do not expect these covenants to adversely impact our ability to execute our

growth strategy or conduct normal business operations.

Unconsolidated Joint Ventures

We have investments in unconsolidated joint ventures in Phoenix, Arizona; Indianapolis, Indiana; and

Dayton, Ohio, which are accounted for under the equity method of accounting. We believe that our transactions

64