Quest Diagnostics 2011 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2011 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.best practices and developing additional initiatives designed to further improve quality and the efficiency of our

operations.

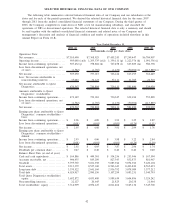

The diagnostic testing industry is labor intensive. Employee compensation and benefits constitute

approximately one-half of our total costs and expenses. Cost of services consists principally of costs for

obtaining, transporting and testing specimens. Selling, general and administrative expenses consist principally of

the costs associated with our sales and marketing efforts, billing operations, bad debt expense, and general

management and administrative support. In addition, performing diagnostic testing involves significant fixed costs

for facilities and other infrastructure required to obtain, transport and test specimens. Therefore, relatively small

changes in volume can have a significant impact on profitability in the short-term.

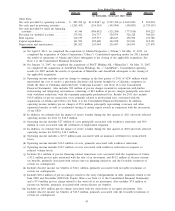

Since a large portion of our costs are fixed, it is more challenging to fully mitigate the profit impact of

reduced volume in the short term. In response to reduced volume levels, as a result of a temporary slowdown in

healthcare utilization, we have implemented a number of actions in 2011 to align our costs with reduced volume

levels. These actions, which are broad in nature and affect most parts of our business, along with other

restructuring and integration activities, resulted in charges to earnings in 2011 totaling $52 million, which

included $42 million of pre-tax charges, principally associated with workforce reductions; with the remainder

principally professional fees.

In addition, in July 2011 we announced a multi-year program designed to reduce our cost structure by $500

million by the end of 2014. This effort is intended to address continued reimbursement pressures and labor and

benefit cost increases, free up additional resources to invest in science and innovation, and enable us to improve

operating profitability. We expect to realize meaningful benefits from this program in 2012, with the bulk of the

savings in 2013 and 2014. We anticipate roughly one-third of the savings from client support/billing, procurement

and supply chain; one-third from laboratory operations and specimen acquisition; and one-third from selling,

general and administrative expenses, including information technology. Common themes across many of the

opportunities include standardizing systems and processes and data bases, increased use of automation and

technology, and centralizing and selective outsourcing of certain activities. As detailed plans to implement these

opportunities are approved and executed, it likely will result in charges to earnings associated with the

implementation. These charges may be material to the results of operations and cash flows in the periods

recorded or paid.

Shareholder Focus

We are focused on increasing shareholder returns and returns on invested capital (“ROIC”) through a

framework that encompasses improving operating performance and disciplined capital deployment. To improve

our operating performance, we are taking steps to accelerate organic revenue growth and to reduce our operating

costs. As noted above, we have launched a program to reduce our operating costs by $500 million by the end of

2014.

Our disciplined capital deployment framework includes dividends, share repurchases and investment in our

business and is intended to improve ROIC. The framework is grounded in maintaining an investment grade credit

rating. In 2012, we expect to use the majority of our free cash flow to reduce our outstanding debt and achieve a

debt/EBITDA ratio in the range of 2–2

1

⁄

4

times. Upon achieving our targeted leverage ratio, we expect to return

to investors through a combination of dividends and share repurchases a majority of our free cash flow.

Consistent with that expectation, we increased our quarterly common stock dividend by 70%, from $0.10 per

share to $0.17 per share, in January 2012. We expect that the dividend will grow over time commensurate with

earnings and cash flows.

We will continue to invest in our business in a disciplined manner which should require significantly less

capital than in recent years. As a result of our 2011 acquisitions of Athena Diagnostics and Celera, we believe

that we have established a solid foundation of strategic assets and capabilities, and that it is unlikely that we will

complete any large strategic acquisitions in the near term. Our near-term investments are likely to focus on

smaller fold-in acquisitions; investments in science and innovation in the form of licensing, collaborations and

internal development; and investments in technology that will improve quality and efficiency in our laboratories

and in other parts of our business. We anticipate that selective acquisitions will enable us to add capabilities and

further strengthen our access and distribution.

48