Quest Diagnostics 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Acquisition of Celera Corporation

On March 17, 2011, the Company entered into a definitive merger agreement with Celera Corporation

(“Celera”) under which the Company agreed to acquire Celera in a transaction valued at approximately $344

million, net of $326 million in acquired cash and short-term marketable securities. Additionally, the Company

expects to utilize Celera’s available tax credits, net operating loss carryforwards and capitalized tax research and

development expenditures to reduce its future tax payments by approximately $110 million. Celera is a healthcare

business focused on the integration of genetic testing into routine clinical care through a combination of products

and services incorporating proprietary discoveries. Celera offers a portfolio of clinical laboratory tests and disease

management services associated with cardiovascular disease. In addition, Celera develops, manufactures and

oversees the commercialization of molecular diagnostic products, and has licensed other relevant diagnostic

technologies developed to provide personalized disease management in cancer and liver diseases. Celera generated

revenues of $128 million in 2010.

Under the terms of the definitive merger agreement, the Company, through a wholly-owned subsidiary,

commenced a cash tender offer to purchase all of the outstanding shares of common stock of Celera for $8 per

share in cash. On May 4, 2011, the Company announced that as a result of the tender offer, the Company had a

controlling ownership interest in Celera. On May 17, 2011, the Company completed the acquisition by means of

a short-form merger, in which the remaining shares of Celera common stock that had not been tendered into the

tender offer were converted into the right to receive $8 per share in cash. The Company has accounted for the

acquisition of Celera as a single transaction, effective May 4, 2011.

Through the acquisition, the Company acquired all of Celera’s operations. The Company financed the all-

cash purchase price of $670 million and related transaction costs with borrowings under its existing credit

facilities and cash on hand. Of the total cash purchase price of $670 million, $669 million was paid through

December 31, 2011. Accounts payable and accrued expenses at December 31, 2011 included a liability of $1

million representing the remaining merger consideration related to shares of Celera which had not been

surrendered as of December 31, 2011.

For the year ended December 31, 2011, transaction costs of $8.7 million were recorded in selling, general

and administrative expenses. Additionally, for the year ended December 31, 2011, financing related costs of $3.1

million were recorded in interest expense, net.

The acquisition of Celera was accounted for under the acquisition method of accounting. As such, the assets

acquired and liabilities assumed are recorded based on their estimated fair values as of the date the Company

acquired its controlling ownership interest in Celera. The consolidated financial statements include the results of

operations of Celera subsequent to the Company acquiring its controlling ownership interest which are not

material to the Company’s consolidated results of operations.

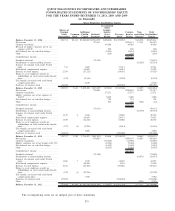

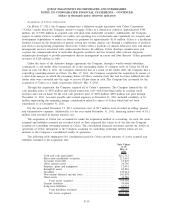

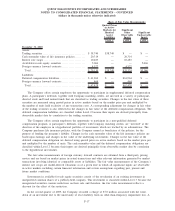

The following table summarizes the consideration paid for Celera and the amounts of assets acquired and

liabilities assumed at the acquisition date:

Fair Values

as of

May 4,

2011

Cash and cash equivalents................................... $112,312

Short-term marketable securities . ............................ 213,418

Accounts receivable......................................... 16,810

Other current assets ......................................... 26,796

Property, plant and equipment . . . ............................ 11,091

Intangible assets ............................................ 85,830

Goodwill ................................................... 135,624

Non-current deferred income taxes ........................... 102,838

Other assets . . .............................................. 34,586

Total assets acquired ................................... 739,305

Current liabilities ........................................... 59,008

Long-term liabilities . . . ..................................... 10,717

Total liabilities assumed ................................ 69,725

Net assets acquired ..................................... $669,580

F-15

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)