Quest Diagnostics 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Other Senior Notes

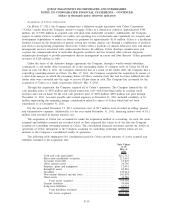

In 2001, the Company issued $275 million aggregate principal amount of 7.50% senior notes due 2011

(“Senior Notes due 2011”). In connection with the Company’s June 2009 Debt Tender Offer and November 2009

Debt Tender Offer, the Company repaid $26 million and $89 million, respectively, outstanding under the Senior

Notes due 2011. In July 2011, the remaining outstanding principal balance of the Senior Notes due 2011 of $159

million was repaid in full at maturity.

On October 31, 2005, the Company completed its $900 million private placement of senior notes (the “2005

Senior Notes”). The 2005 Senior Notes were priced in two tranches: (a) $400 million aggregate principal amount

of 5.125% senior notes due November 2010 (“Senior Notes due 2010”); and (b) $500 million aggregate principal

amount of 5.45% senior notes due November 2015 (“Senior Notes due 2015”). The Senior Notes due 2010 and

2015 were issued at a discount of $0.8 million and $1.6 million, respectively. After considering the discounts, the

effective interest rates on the Senior Notes due 2010 and 2015 are 5.3% and 5.6%, respectively. The 2005 Senior

Notes require semi-annual interest payments, which commenced on May 1, 2006. The 2005 Senior Notes are

unsecured obligations of the Company and rank equally with the Company’s other senior unsecured obligations.

The 2005 Senior Notes are guaranteed by the Subsidiary Guarantors. In connection with the Company’s June

2009 Debt Tender Offer and November 2009 Debt Tender Offer, the Company repaid $174 million and $61

million, respectively, outstanding under the Senior Notes due 2010. In November 2010, the remaining outstanding

principal balance of the Senior Notes due 2010 of $166 million was repaid in full at maturity.

On June 22, 2007, the Company completed an $800 million senior notes offering (the “2007 Senior Notes”).

The 2007 Senior Notes were priced in two tranches: (a) $375 million aggregate principal amount of 6.40% senior

notes due July 2017 (the “Senior Notes due 2017”), issued at a discount of $0.8 million and (b) $425 million

aggregate principal amount of 6.95% senior notes due July 2037 (the “Senior Notes due 2037”), issued at a

discount of $4.7 million. After considering the discounts, the effective interest rates on the Senior Notes due

2017 and the Senior Notes due 2037 are 6.4% and 7.0%, respectively. The 2007 Senior Notes require semi-

annual interest payments, which commenced on January 1, 2008. The 2007 Senior Notes are unsecured

obligations of the Company and rank equally with the Company’s other senior unsecured obligations. The 2007

Senior Notes do not have a sinking fund requirement and are guaranteed by the Subsidiary Guarantors.

On November 17, 2009, the Company completed a $750 million senior notes offering (the “2009 Senior

Notes”). The 2009 Senior Notes were sold in two tranches: (a) $500 million aggregate principal amount of 4.75%

senior notes due January 30, 2020 (the “Senior Notes due 2020”), issued at a discount of $7.5 million and (b)

$250 million aggregate principal amount of 5.75% senior notes due January 30, 2040, issued at a discount of

$6.9 million. After considering the discounts, the effective interest rates on the Senior Notes due 2020 and the

Senior Notes due 2040 are 4.9% and 5.9%, respectively. The 2009 Senior Notes require semi-annual interest

payments, which commenced on July 30, 2010. The 2009 Senior Notes are unsecured obligations of the

Company and rank equally with the Company’s other senior unsecured obligations. The 2009 Senior Notes do

not have a sinking fund requirement and are guaranteed by the Subsidiary Guarantors.

As further discussed in Note 12, the Company has hedged its interest rate exposure on a portion of the

Senior Notes due 2016 and on a portion of the Senior Notes due 2020 through the use of certain derivative

financial instruments which have been designated as fair value hedges. The carrying value of the Senior Notes

due 2016 has been increased by the fair value of the related hedge of $10.9 million in the consolidated balance

sheet as of December 31, 2011. At December 31, 2011 and 2010, the carrying value of the Senior Notes due

2020 has been increased by the fair value of the related hedge of $45.6 million and $10.5 million, respectively.

F-25

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)