Quest Diagnostics 2011 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2011 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

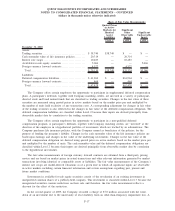

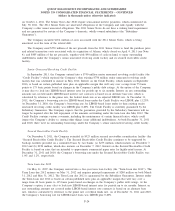

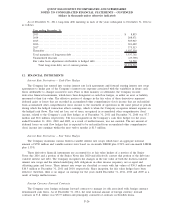

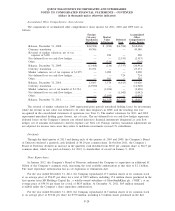

As of December 31, 2011, long-term debt maturing in each of the years subsequent to December 31, 2012 is

as follows:

Year ending December 31,

2013 ...................................................................... $ 8,853

2014 ...................................................................... 208,471

2015 ...................................................................... 505,927

2016 ...................................................................... 301,689

2017 ...................................................................... 375,513

Thereafter . . . .............................................................. 1,937,339

Total maturities of long-term debt .......................................... 3,337,792

Unamortized discount . ..................................................... (23,790)

Fair value basis adjustment attributable to hedged debt....................... 56,520

Total long-term debt, net of current portion............................. $3,370,522

12. FINANCIAL INSTRUMENTS

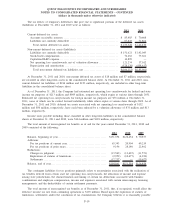

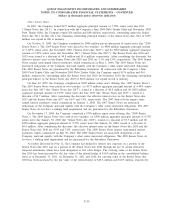

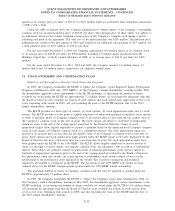

Interest Rate Derivatives – Cash Flow Hedges

The Company has entered into various interest rate lock agreements and forward starting interest rate swap

agreements to hedge part of the Company’s interest rate exposure associated with the variability in future cash

flows attributable to changes in interest rates. Prior to their maturity or settlement, the Company records

derivative financial instruments, which have been designated as cash flow hedges, as either an asset or liability

measured at their fair value. The effective portion of changes in the fair value of these derivatives represent

deferred gains or losses that are recorded in accumulated other comprehensive (loss) income that are reclassified

from accumulated other comprehensive (loss) income to the statement of operations in the same period or periods

during which the hedged transaction affects earnings, which is when the Company recognizes interest expense on

the hedged cash flows. The total net loss, net of taxes, recognized in accumulated other comprehensive (loss)

income, related to the Company’s cash flow hedges as of December 31, 2011 and December 31, 2010 was $7.7

million and $6.6 million, respectively. The loss recognized on the Company’s cash flow hedges for the years

ended December 31, 2011, 2010 and 2009, as a result of ineffectiveness, was not material. The net amount of

deferred losses on cash flow hedges that is expected to be reclassified from accumulated other comprehensive

(loss) income into earnings within the next twelve months is $1.3 million.

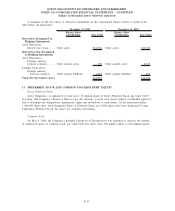

Interest Rate Derivatives – Fair Value Hedges

The Company maintains various fixed-to-variable interest rate swaps which have an aggregate notional

amount of $550 million and variable interest rates based on six-month LIBOR plus 0.54% and one-month LIBOR

plus 1.33%.

These derivative financial instruments are accounted for as fair value hedges of a portion of the Senior

Notes due 2016 and a portion of the Senior Notes due 2020 and effectively convert that portion of the debt into

variable interest rate debt. The Company recognizes the changes in the fair value of both the fixed-to-variable

interest rate swaps and the related underlying debt obligations in other income (expense), net as equal and

offsetting gains and losses. These interest rate swaps are classified as assets with fair values of $56.5 million and

$10.5 million at December 31, 2011 and 2010, respectively. Since inception, the fair value hedges have been

effective; therefore, there is no impact on earnings for the years ended December 31, 2011, 2010 and 2009 as a

result of hedge ineffectiveness.

Foreign Currency Forward Contracts

The Company uses foreign exchange forward contracts to manage its risk associated with foreign currency

denominated cash flows. As of December 31, 2011, the total notional amount of foreign currency forward

contracts in U.S. dollars was $37.9 million and principally consisted of contracts in Swedish krona.

F-26

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)