Quest Diagnostics 2011 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2011 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

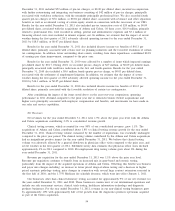

Selling, General and Administrative Expenses

The increase in selling, general and administrative expenses as a percentage of net revenues for the year

ended December 31, 2011 compared to the prior year primarily reflects the impact of severe weather, a $9.4

million increase in pre-tax charges, primarily associated with restructuring and integration activities, costs incurred

in connection with the succession of our CEO, higher costs associated with employee compensation and benefits,

and investments we have made in our sales force. In addition, selling, general and administrative expenses for the

year ended December 31, 2011 included pre-tax transaction costs of $16.9 million, primarily related to

professional fees associated with the acquisitions of Athena and Celera. These increases have been partially offset

by actions we have taken to reduce our cost structure and an improvement in bad debt expense as a percentage

of net revenues, primarily reflecting continued strong performance in our billing operations and collection metrics.

Amortization of Intangible Assets

The increase in amortization of intangible assets for the year ended December 31, 2011 compared to the

prior year reflects the impact of amortization of intangible assets acquired as part of the Athena and Celera

acquisitions.

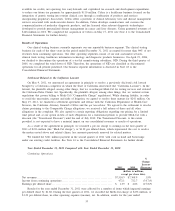

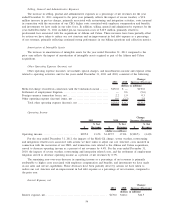

Other Operating Expense (Income), net

Other operating expense (income), net includes special charges, and miscellaneous income and expense items

related to operating activities, and for the years ended December 31, 2011 and 2010, consisted of the following:

2011 2010

Change:

Increase (Decrease)

(dollars in millions)

Medi-Cal charge recorded in connection with the California Lawsuit . ...... $236.0 $ — $236.0

Settlement of employment litigation....................................... — 9.6 (9.6)

Foreign currency transaction losses, net . .................................. 2.2 1.9 0.3

Other operating expense (income) items, net .............................. 0.6 (2.2) 2.8

Total other operating expense (income), net . ......................... $238.8 $ 9.3 $229.5

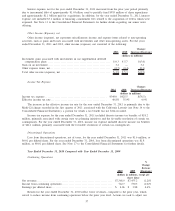

Operating Income

$

% Net

Revenues $

% Net

Revenues $

% Net

Revenues

2011 2010

Change:

Increase (Decrease)

(dollars in millions)

Operating income . ............................. $995.0 13.2% $1,295.5 17.6% $(300.5) (4.4)%

For the year ended December 31, 2011, the impacts of the Medi-Cal charge, severe weather, restructuring

and integration related costs associated with actions we have taken to adjust our cost structure, costs incurred in

connection with the succession of our CEO, and transaction costs related to the Athena and Celera acquisitions,

served to decrease operating income as a percent of net revenues by 4.4%. For the year ended December 31,

2010, the impacts of severe weather, restructuring and integration related costs, and the settlement of employment

litigation served to decrease operating income as a percent of net revenues by 0.7%.

The remaining year-over-year decrease in operating income as a percentage of net revenues is primarily

attributable to higher costs associated with employee compensation and benefits, and investments we have made

in our sales and service capabilities. These decreases have been partially offset by actions we have taken to

reduce our cost structure and an improvement in bad debt expense as a percentage of net revenues, compared to

the prior year.

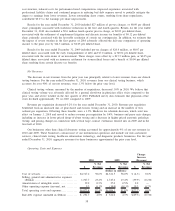

Interest Expense, net

2011 2010

Change:

Increase (Decrease)

(dollars in millions)

Interest expense, net. ................................................... $170.6 $146.1 $24.5

56