Quest Diagnostics 2011 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2011 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Celera’s operations are included in the Company’s clinical laboratory testing business, with the remainder in other

operating segments.

On April 19, 2006, the Company decided to discontinue NID’s operations and results of operations for NID

have been classified as discontinued operations for all years presented (see Note 17).

At December 31, 2011, substantially all of the Company’s services are provided within the United States,

and substantially all of the Company’s assets are located within the United States.

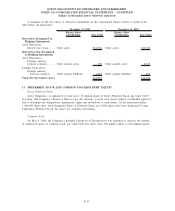

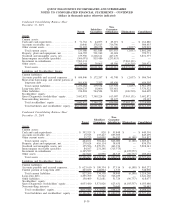

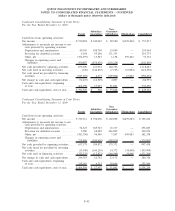

The following table is a summary of segment information for the years ended December 31, 2011, 2010 and

2009. Segment asset information is not presented since it is not used by the chief operating decision maker at the

operating segment level. Operating earnings (loss) of each segment represents net revenues less directly

identifiable expenses to arrive at operating income for the segment. General management and administrative

corporate expenses, including amortization of intangible assets and the charge to earnings in the first quarter of

2011 of $236 million related to the settlement of the California Lawsuit (see Note 16), are included in general

corporate expenses below. The accounting policies of the segments are the same as those of the Company as set

forth in Note 2.

2011 2010 2009

Net revenues:

Clinical testing business .......................... $6,814,456 $6,738,604 $6,824,149

All other operating segments...................... 696,034 630,321 631,094

Total net revenues................................ $7,510,490 $7,368,925 $7,455,243

Operating earnings (loss):

Clinical testing business .......................... $1,403,797 $1,424,173 $1,491,131

All other operating segments...................... 73,356 44,314 59,862

General corporate expenses ....................... (482,105) (172,952) (191,882)

Total operating income ........................... 995,048 1,295,535 1,359,111

Non-operating expenses, net ...................... (138,816) (111,200) (131,179)

Income from continuing operations before taxes . 856,232 1,184,335 1,227,932

Income tax expense.............................. 349,000 425,531 460,474

Income from continuing operations .............. 507,232 758,804 767,458

Loss from discontinued operations, net of taxes. . (1,582) (1,787) (1,236)

Net income ...................................... 505,650 757,017 766,222

Less: Net income attributable to noncontrolling

interests....................................... 35,083 36,123 37,111

Net income attributable to Quest Diagnostics .... $ 470,567 $ 720,894 $ 729,111

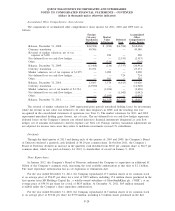

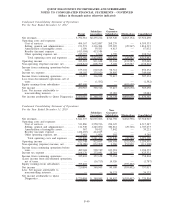

2011 2010 2009

Depreciation and amortization:

Clinical testing business ........................ $188,820 $194,655 $200,905

All other operating segments . .................. 21,356 17,457 17,337

General corporate . . . ........................... 70,926 41,852 38,445

Total depreciation and amortization ............. $281,102 $253,964 $256,687

Capital expenditures:

Clinical testing business ........................ $132,024 $166,445 $136,248

All other operating segments . .................. 22,706 29,803 23,592

General corporate . . . ........................... 6,826 9,152 7,088

Total capital expenditures ...................... $161,556 $205,400 $166,928

19. SUMMARIZED FINANCIAL INFORMATION

The Company’s Floating Rate Senior Notes due 2014, Senior Notes due 2015, Senior Notes due 2016,

Senior Notes due 2017, Senior Notes due 2020, Senior Notes due 2021, Senior Notes due 2037 and Senior Notes

F-37

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)