Quest Diagnostics 2011 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2011 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrant’s Common Stock, Related Stockholder Matters and Issuer Purchases of

Equity Securities

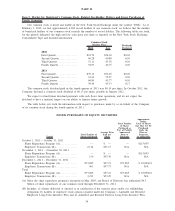

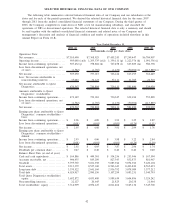

Our common stock is listed and traded on the New York Stock Exchange under the symbol “DGX.” As of

February 1, 2012, we had approximately 4,200 record holders of our common stock; we believe that the number

of beneficial holders of our common stock exceeds the number of record holders. The following table sets forth,

for the periods indicated, the high and low sales price per share as reported on the New York Stock Exchange

Consolidated Tape and dividend information.

High Low

Dividends

Declared

Common Stock

Market Price

2010

First Quarter .................. $61.72 $54.63 $0.10

Second Quarter ............... 60.28 40.80 0.10

Third Quarter ................. 51.11 43.38 0.10

Fourth Quarter ................ 54.93 46.75 0.10

2011

First Quarter .................. $59.11 $52.65 $0.10

Second Quarter ............... 61.21 55.27 0.10

Third Quarter ................. 60.80 45.77 0.10

Fourth Quarter ................ 59.44 45.13 0.17

The common stock dividend paid in the fourth quarter of 2011 was $0.10 per share. In October 2011, the

Company declared a common stock dividend of $0.17 per share, payable in January 2012.

We expect to fund future dividend payments with cash flows from operations, and do not expect the

dividend to have a material impact on our ability to finance future growth.

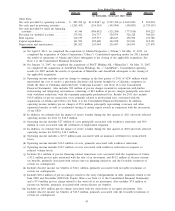

The table below sets forth the information with respect to purchases made by or on behalf of the Company

of its common stock during the fourth quarter of 2011.

ISSUER PURCHASES OF EQUITY SECURITIES

Period

Total Number of

Shares Purchased

Average Price

Paid per

Share

Total Number

of Shares

Purchased as

Part of Publicly

Announced

Plans or

Programs

Approximate

Dollar

Value of Shares

that May Yet Be

Purchased

Under the

Plans or

Programs

(in thousands)

October 1, 2011 – October 31, 2011

Share Repurchase Program (A)............... — $ — — $115,055

Employee Transactions (B) .................. 2,114 $51.15 N/A N/A

November 1, 2011 – November 30, 2011

Share Repurchase Program (A)............... — $ — — $115,055

Employee Transactions (B) .................. 136 $55.30 N/A N/A

December 1, 2011 – December 31, 2011

Share Repurchase Program (A)............... 873,885 $57.21 873,885 $ 65,056(C)

Employee Transactions (B) .................. 961 $57.73 N/A N/A

Total

Share Repurchase Program (A)............... 873,885 $57.21 873,885 $ 65,056(C)

Employee Transactions (B) .................. 3,211 $53.29 N/A N/A

(A) Since the share repurchase program’s inception in May 2003, our Board of Directors has authorized $4.5

billion of share repurchases of our common stock through December 31, 2011.

(B) Includes: (1) shares delivered or attested to in satisfaction of the exercise price and/or tax withholding

obligations by holders of employee stock options (granted under the Company’s Amended and Restated

Employee Long-Term Incentive Plan and its Amended and Restated Director Long-Term Incentive Plan,

36