Quest Diagnostics 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

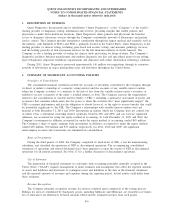

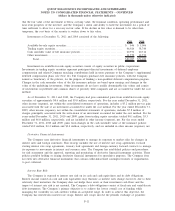

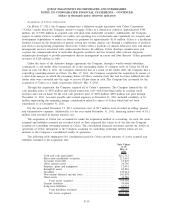

The following securities were not included in the diluted earnings per share calculation due to their

antidilutive effect (in thousands):

2011 2010 2009

Stock options and performance share units ........................... 2,259 2,886 3,559

4. BUSINESS ACQUISITIONS

Acquisition of Athena Diagnostics

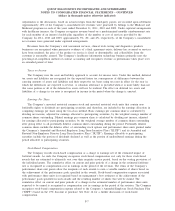

On April 4, 2011, the Company completed its acquisition of Athena Diagnostics (“Athena”) in an all-cash

transaction valued at $740 million. Athena is the leading provider of advanced diagnostic tests related to

neurological conditions, and generated revenues of approximately $110 million in 2010.

Through the acquisition, the Company acquired all of Athena’s operations. The Company financed the all-

cash purchase price of $740 million and related transaction costs with a portion of the net proceeds from the

Company’s 2011 Senior Notes Offering. For the year ended December 31, 2011, transaction costs of $8.2 million

were recorded in selling, general and administrative expenses. See Note 11 for further discussion of the 2011

Senior Notes Offering.

The acquisition of Athena was accounted for under the acquisition method of accounting. As such, the assets

acquired and liabilities assumed are recorded based on their estimated fair values as of the closing date. The

consolidated financial statements include the results of operations of Athena subsequent to the closing of the

acquisition which are not material to the Company’s consolidated results of operations.

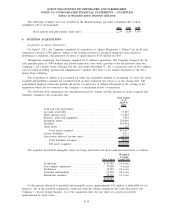

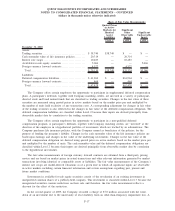

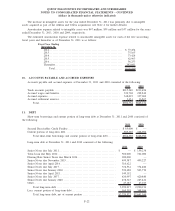

The following table summarizes the consideration paid for Athena and the amounts of assets acquired and

liabilities assumed at the acquisition date:

Fair Values

as of

April 4,

2011

Cash and cash equivalents................................... $ —

Accounts receivable......................................... 17,853

Other current assets ......................................... 13,427

Property, plant and equipment . . . ............................ 3,038

Intangible assets ............................................ 220,040

Goodwill ................................................... 563,974

Other assets . . .............................................. 135

Total assets acquired ................................... 818,467

Current liabilities ........................................... 8,511

Non-current deferred income taxes ........................... 69,956

Total liabilities assumed ................................ 78,467

Net assets acquired ..................................... $740,000

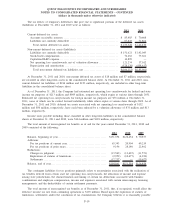

The acquired amortizable intangible assets are being amortized over their estimated useful lives as follows:

Fair Values

Weighted

Average

Useful Life

Technology .................................... $ 92,580 16 years

Non-compete agreement . . . ..................... 37,000 4 years

Tradename..................................... 34,520 10 years

Customer relationships.......................... 21,420 20 years

Informatics database............................ 34,520 10 years

$220,040

Of the amount allocated to goodwill and intangible assets, approximately $42 million is deductible for tax

purposes. All of the goodwill acquired in connection with the Athena acquisition has been allocated to the

Company’s clinical testing business. As of the acquisition date, the fair value of accounts receivable

approximated its book value.

F-14

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)