Quest Diagnostics 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fair Value Measurements

The Company determines fair value measurements used in its consolidated financial statements based upon

the exit price that would be received to sell an asset or paid to transfer a liability in an orderly transaction

between market participants exclusive of any transaction costs, as determined by either the principal market or

the most advantageous market.

Inputs used in the valuation techniques to derive fair values are classified based on a three-level hierarchy.

The basis for fair value measurements for each level within the hierarchy is described below with Level 1 having

the highest priority and Level 3 having the lowest.

Level 1: Quoted prices in active markets for identical assets or liabilities.

Level 2: Quoted prices for similar assets or liabilities in active markets; quoted prices for

identical or similar instruments in markets that are not active; and model-derived

valuations in which all significant inputs are observable in active markets.

Level 3: Valuations derived from valuation techniques in which one or more significant inputs

are unobservable.

Foreign Currency

The Company predominately uses the U.S. dollar as its functional currency. The functional currency of the

Company’s foreign subsidiaries is the applicable local currency. Assets and liabilities denominated in non-U.S.

dollars are translated into U.S. dollars at exchange rates as of the end of the reporting period. Income and

expense items are translated at average exchange rates prevailing during the year. The translation adjustments are

recorded as a component of accumulated other comprehensive (loss) income within stockholders’ equity. Gains

and losses from foreign currency transactions are included within other operating expense (income), net in the

consolidated statements of operations. Transaction gains and losses have not been material. For a discussion of

the Company’s use of derivative financial instruments to manage its exposure for changes in foreign currency

rates refer to the caption entitled “Derivative Financial Instruments – Foreign Currency Risk” below.

Cash and Cash Equivalents

Cash and cash equivalents include all highly-liquid investments with original maturities, at the time acquired

by the Company, of three months or less.

Concentration of Credit Risk

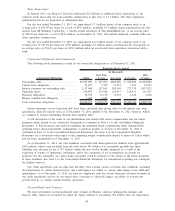

Financial instruments that potentially subject the Company to concentrations of credit risk are principally

cash, cash equivalents, short-term investments, accounts receivable and derivative financial instruments. The

Company’s policy is to place its cash, cash equivalents and short-term investments in highly-rated financial

instruments and institutions. Concentration of credit risk with respect to accounts receivable is mitigated by the

diversity of the Company’s payers and their dispersion across many different geographic regions, and is limited

to certain payers who are large buyers of the Company’s services. To reduce risk, the Company routinely

assesses the financial strength of these payers and, consequently, believes that its accounts receivable credit risk

exposure, with respect to these payers, is limited. While the Company has receivables due from federal and state

governmental agencies, the Company does not believe that such receivables represent a credit risk since the

related healthcare programs are funded by federal and state governments, and payment is primarily dependent on

submitting appropriate documentation. At both December 31, 2011 and 2010, receivables due from government

payers under the Medicare and Medicaid programs represent approximately 16% of the Company’s consolidated

net accounts receivable. The portion of the Company’s accounts receivable due from patients comprises the

largest portion of credit risk. As of December 31, 2011 and 2010, receivables due from patients represent

approximately 18% and 19%, respectively, of the Company’s consolidated net accounts receivable. The Company

applies assumptions and judgments including historical collection experience for assessing collectibility and

determining allowances for doubtful accounts for accounts receivable from patients.

F-8

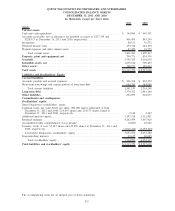

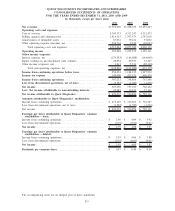

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - CONTINUED

(dollars in thousands unless otherwise indicated)