Oracle 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

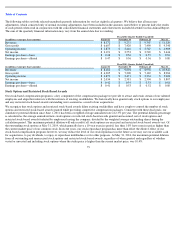

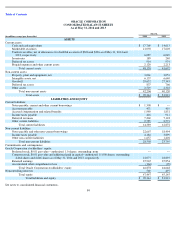

Foreign Currency Translation Risk—Impact on Cash, Cash Equivalents and Marketable Securities

Fluctuations in foreign currencies impact the amount of total assets and liabilities that we report for our foreign subsidiaries upon the translation

of these amounts into U.S. Dollars. In particular, the amount of cash, cash equivalents and marketable securities that we report in U.S. Dollars

for a significant portion of the cash held by these subsidiaries is subject to translation variance caused by changes in foreign currency exchange

rates as of the end of each respective reporting period (the offset to which is recorded to accumulated other comprehensive loss on our

consolidated balance sheet and is also presented as a line item in our consolidated statements of comprehensive income included elsewhere in

this Annual Report).

As the U.S. Dollar fluctuated against certain international currencies as of the end of fiscal 2014, the amount of cash, cash equivalents and

marketable securities that we reported in U.S. Dollars for foreign subsidiaries that hold international currencies as of May 31, 2014 decreased

relative to what we would have reported using a constant currency rate as of May 31, 2013. As reported in our consolidated statements of cash

flows, the estimated effect of exchange rate changes on our reported cash and cash equivalents balances in U.S. Dollars for fiscal 2014, 2013 and

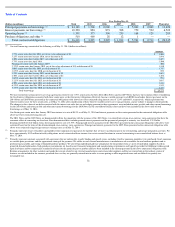

2012 were decreases of $158 million, $110 million and $471 million, respectively. The following table includes estimates of the U.S. Dollar

equivalent of cash, cash equivalents and marketable securities denominated in certain major foreign currencies as of May 31, 2014:

If overall foreign currency exchange rates in comparison to the U.S. Dollar uniformly weakened by 10%, the amount of cash, cash equivalents

and marketable securities we would report in U.S. Dollars would decrease by approximately $802 million, assuming constant foreign currency

cash, cash equivalents and marketable securities balances.

Item 8. Financial Statements and Supplementary Data

The response to this item is submitted as a separate section of this Annual Report. See Part IV, Item 15.

Item 9. Changes In and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

Evaluation of Disclosure Controls and Procedures

As of the end of the period covered by this Annual Report on Form 10-K, we carried out an evaluation under the supervision and with the

participation of our Disclosure Committee and our management, including our Chief Executive Officer and our President and Chief Financial

Officer, of the effectiveness of the design and operation of our disclosure controls and procedures pursuant to Exchange Act Rules 13a-

15(e) and

15d-15(e). Disclosure controls are procedures that are designed to ensure that information required to be disclosed in our reports filed under the

Securities Exchange Act of 1934, or the Exchange Act, such as this Annual Report on Form 10-K, is recorded, processed, summarized and

reported within the time periods specified by the U.S. Securities and Exchange Commission. Disclosure controls are also designed to ensure that

such information is accumulated and communicated to our

77

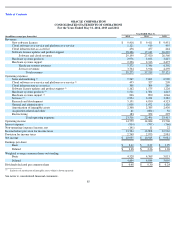

(in millions)

U.S. Dollar

Equivalent at

May 31, 2014

Euro

$

1,843

Indian Rupee

1,172

Australian Dollar

724

Japanese Yen

550

Chinese Renminbi

535

Canadian Dollar

385

South African Rand

341

British Pound

325

Other foreign currencies

2,148

Total cash, cash equivalents and marketable securities denominated in foreign currencies

$

8,023