Oracle 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

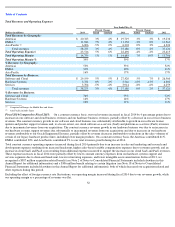

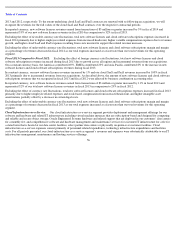

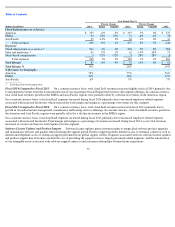

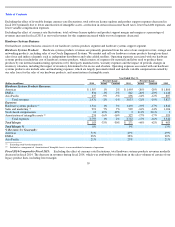

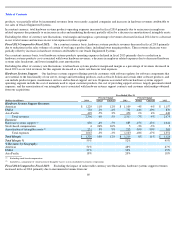

Fiscal 2013 Compared to Fiscal 2012: Excluding the effect of foreign currency rate fluctuations, our total revenues increased in fiscal 2013

due to an increase in our software and cloud business revenues. This constant currency increase was partially offset by reductions in our

hardware systems and services business’ revenues. On a constant currency basis, the Americas region contributed 77% and the Asia Pacific

region contributed 23% to our growth in total revenues during fiscal 2013.

Excluding the effect of foreign currency rate fluctuations, total operating expenses decreased in fiscal 2013 primarily due to a $387 million

acquisition related benefit and a $306 million benefit related to certain litigation (both as noted above), lower hardware systems products costs

associated with lower hardware systems products revenues, and certain other operating expense decreases in most of our other lines of business

primarily due to lower variable compensation expenses, lower external contractor expenses and lower amortization of intangible assets. In

constant currency, these total expense decreases during fiscal 2013 were partially offset by higher salary and benefit expenses due primarily to

additional sales and marketing and research and development headcount added during fiscal 2013.

Excluding the effect of foreign currency rate fluctuations, our total operating margin and our total operating margin as a percentage of total

revenues increased during fiscal 2013 due to the increase in our total revenues and the decrease in our total operating expenses.

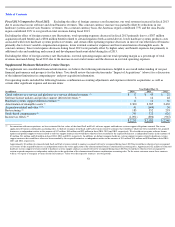

Supplemental Disclosure Related to Certain Charges

To supplement our consolidated financial information, we believe the following information is helpful to an overall understanding of our past

financial performance and prospects for the future. You should review the introduction under “Impact of Acquisitions” (above) for a discussion

of the inherent limitations in comparing pre- and post-acquisition information.

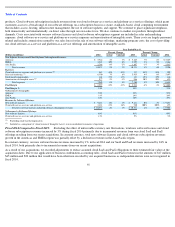

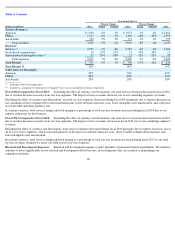

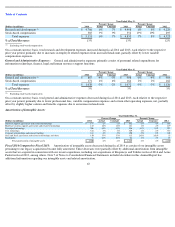

Our operating results included the following business combination accounting adjustments and expenses related to acquisitions, as well as

certain other significant expense and income items:

53

Year Ended May 31,

(in millions)

2014

2013

2012

Cloud software

-

as

-

a

-

service and platform

-

as

-

a

-

service deferred revenues

$

17

$

45

$

22

Software license updates and product support deferred revenues

3

14

48

Hardware systems support deferred revenues

11

14

30

Amortization of intangible assets

2,300

2,385

2,430

Acquisition related and other

41

(604

)

56

Restructuring

183

352

295

Stock

-

based compensation

795

722

626

Income tax effects

(1,091

)

(896

)

(967

)

$

2,259

$

2,032

$

2,540

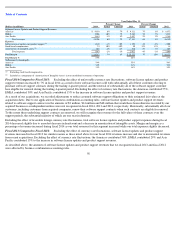

In connection with our acquisitions, we have estimated the fair values of the cloud SaaS and PaaS, software support and hardware systems support obligations assumed. Due to our

application of business combination accounting rules, we did not recognize cloud SaaS and PaaS revenues related to contracts that would have otherwise been recorded by the acquired

businesses as independent entities in the amounts of $17 million, $45 million and $22 million in fiscal 2014, 2013 and 2012, respectively. We also did not recognize software license

updates and product support revenues related to software support contracts that would have otherwise been recorded by the acquired businesses as independent entities in the amounts of

$3 million, $14 million and $48 million in fiscal 2014, 2013 and 2012, respectively. In addition, we did not recognize hardware systems support revenues related to hardware systems

support contracts that would have otherwise been recorded by the acquired businesses as independent entities in the amounts of $11 million, $14 million and $30 million in fiscal 2014,

2013 and 2012, respectively.

Approximately $3 million of estimated cloud SaaS and PaaS revenues related to contracts assumed will not be recognized during fiscal 2015 that would have otherwise been recognized

as revenues by the acquired businesses as independent entities due to the application of the aforementioned business combination accounting rules. Approximately $2 million of estimated

hardware systems support revenues related to hardware systems support contracts assumed will not be recognized during fiscal 2015 that would have otherwise been recognized by

certain acquired companies as independent entities due to the application of the aforementioned business combination accounting rules. To the extent customers renew these contracts

with us, we expect to recognize revenues for the full contracts

’

values over the respective contracts

’

renewal periods.

(1)

(1)

(1)

(2)

(3)(5)

(4)

(5)

(6)

(1)