Oracle 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

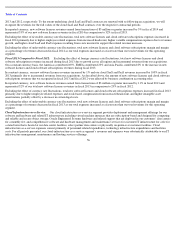

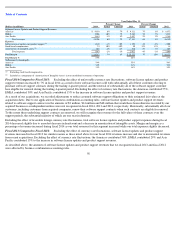

Excluding the effect of favorable foreign currency rate fluctuations, total software license updates and product support expenses decreased in

fiscal 2013 primarily due to lower amortization of intangible assets, a reduction in certain non-income based taxes, lower bad debt expenses, and

lower variable compensation expenses.

Excluding the effect of currency rate fluctuations, total software license updates and product support margin and margin as a percentage of

revenues increased in fiscal 2013 as our total revenues for this segment increased while our total expenses decreased.

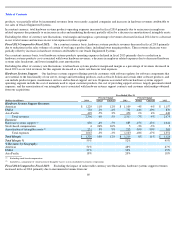

Hardware Systems Business

Our hardware systems business consists of our hardware systems products segment and hardware systems support segment.

Hardware Systems Products:

Hardware systems products revenues are primarily generated from the sales of our computer server, storage and

networking products, including sales of our Oracle Engineered Systems. We market and sell our hardware systems products through our direct

sales force and indirect channels such as independent distributors and value added resellers. Operating expenses associated with our hardware

systems products include the cost of hardware systems products, which consists of expenses for materials and labor used to produce these

products by our internal manufacturing operations or by third party manufacturers, warranty expenses and the impact of periodic changes in

inventory valuation, including the impact of inventory determined to be excess and obsolete. Operating expenses associated with our hardware

systems products also include sales and marketing expenses, which are largely personnel related and include variable compensation earned by

our sales force for the sales of our hardware products, and amortization of intangible assets.

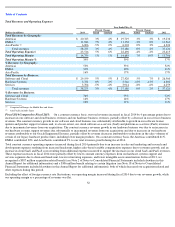

Fiscal 2014 Compared to Fiscal 2013: Excluding the effect of currency rate fluctuations, total hardware systems products revenues modestly

decreased in fiscal 2014. The decrease in revenues during fiscal 2014, which was attributable to reductions in the sales volumes of certain of our

legacy product lines, including lower margin

59

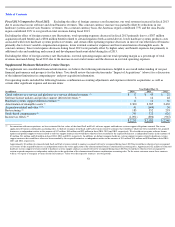

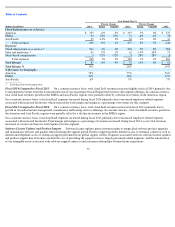

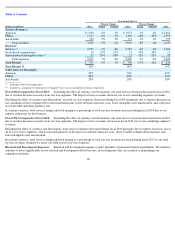

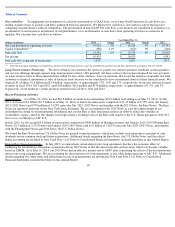

Year Ended May 31,

Percent Change

Percent Change

(Dollars in millions)

2014

Actual

Constant

2013

Actual

Constant

2012

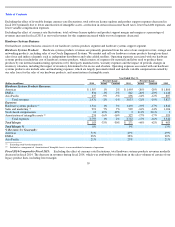

Hardware Systems Products Revenues:

Americas

$

1,507

1%

2%

$

1,495

-

20%

-

20%

$

1,880

EMEA

834

-

1%

-

3%

842

-

26%

-

23%

1,140

Asia Pacific

635

-

9%

-

5%

696

-

14%

-

12%

807

Total revenues

2,976

-

2%

-

1%

3,033

-

21%

-

19%

3,827

Expenses:

Hardware systems products

1,516

1%

3%

1,498

-

19%

-

17%

1,842

Sales and marketing

991

7%

7%

929

-

16%

-

14%

1,106

Stock

-

based compensation

12

49%

49%

8

211%

211%

3

Amortization of intangible assets

274

-

16%

-

16%

327

-

17%

-

17%

393

Total expenses

2,793

1%

2%

2,762

-

17%

-

16%

3,344

Total Margin

$

183

-

33%

-

30%

$

271

-

44%

-

42%

$

483

Total Margin %

6%

9%

13%

% Revenues by Geography:

Americas

51%

49%

49%

EMEA

28%

28%

30%

Asia Pacific

21%

23%

21%

Excluding stock

-

based compensation

Included as a component of

‘

Amortization of Intangible Assets

’

in our consolidated statements of operations

(1)

(1)

(2)

(1)

(2)