Oracle 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

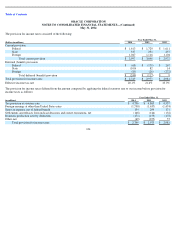

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2014

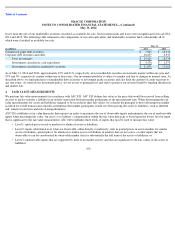

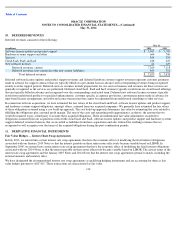

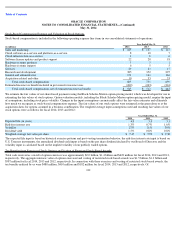

Deferred revenues consisted of the following:

Deferred software license updates and product support revenues and deferred hardware systems support revenues represent customer payments

made in advance for support contracts that are typically billed on a per annum basis in advance with corresponding revenues being recognized

ratably over the support periods. Deferred services revenues include prepayments for our services business and revenues for these services are

generally recognized as the services are performed. Deferred cloud SaaS, PaaS and IaaS revenues typically result from our cloud-

based offerings

that are typically billed in advance and recognized over the corresponding contractual term. Deferred new software licenses revenues typically

result from undelivered products or specified enhancements, customer specific acceptance provisions, customer payments made in advance for

time-based license arrangements and software license transactions that cannot be segmented from undelivered consulting or other services.

In connection with our acquisitions, we have estimated the fair values of the cloud SaaS and PaaS, software license updates and product support,

and hardware systems support obligations, amongst others, assumed from our acquired companies. We generally have estimated the fair values

of these obligations assumed using a cost build-up approach. The cost build-up approach determines fair value by estimating the costs related to

fulfilling the obligations plus a normal profit margin. The sum of the costs and operating profit approximates, in theory, the amount that we

would be required to pay a third party to assume these acquired obligations. These aforementioned fair value adjustments recorded for

obligations assumed from our acquisitions reduced the cloud SaaS and PaaS, software license updates and product support and hardware systems

support deferred revenues balances that we recorded as liabilities from these acquisitions and also reduced the resulting revenues that we

recognized or will recognize over the terms of the acquired obligations during the post-combination periods.

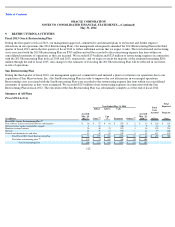

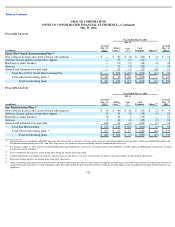

Fair Value Hedges — Interest Rate Swap Agreements

In July 2013, we entered into certain interest rate swap agreements that have the economic effect of modifying the fixed interest obligations

associated with our January 2019 Notes so that the interest payable on these senior notes effectively became variable based on LIBOR. In

September 2009, we entered into certain interest rate swap agreements that have the economic effect of modifying the fixed interest obligations

associated with our 2014 Notes so that the interest payable on these notes effectively became variable based on LIBOR. The critical terms of the

interest rate swap agreements and the January 2019 Notes and 2014 Notes that the interest rate swap agreements pertain to match, including the

notional amounts and maturity dates.

We have designated the aforementioned interest rate swap agreements as qualifying hedging instruments and are accounting for them as fair

value hedges pursuant to ASC 815. These transactions are characterized as fair value

114

10.

DEFERRED REVENUES

May 31,

(in millions)

2014

2013

Software license updates and product support

$

5,909

$

5,705

Hardware systems support and other

664

706

Services

364

355

Cloud SaaS, PaaS and IaaS

248

223

New software licenses

84

129

Deferred revenues, current

7,269

7,118

Deferred revenues, non

-

current (in other non

-

current liabilities)

404

312

Total deferred revenues

$

7,673

$

7,430

11.

DERIVATIVE FINANCIAL INSTRUMENTS