Oracle 2013 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

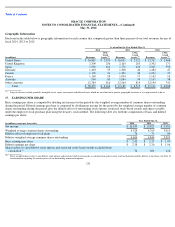

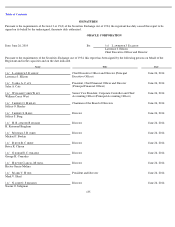

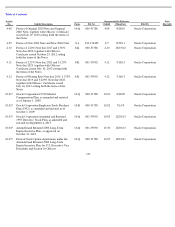

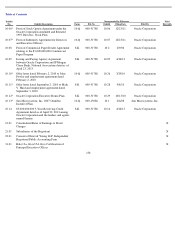

Table of Contents

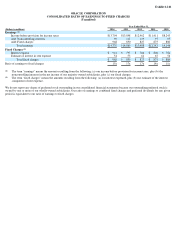

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2014

oral argument has not yet been scheduled. We cannot currently estimate a reasonably possible range of loss for this action. We believe that we

have meritorious defenses against this action, and we will continue to vigorously defend it.

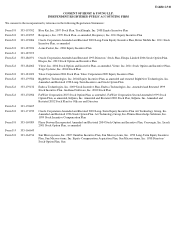

Derivative Litigations and Related Action

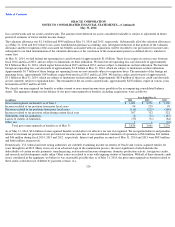

On September 30, 2011, a stockholder derivative lawsuit was filed in the Delaware Court of Chancery and a second stockholder was permitted to

intervene as a plaintiff on November 15, 2011. At an August 22, 2012, hearing, the court dismissed certain claims but permitted certain claims

for breach of fiduciary duty to proceed. On May 3, 2013, plaintiffs filed an amended complaint. The derivative suit is brought by two alleged

stockholders of Oracle, purportedly on Oracle’s behalf, against one former director and all but two of our current directors, including against our

Chief Executive Officer as an alleged controlling stockholder. Plaintiffs allege that Oracle’s directors breached their fiduciary duties in agreeing

to purchase Pillar Data Systems, Inc. at an excessive price. Oracle’s acquisition of Pillar is structured as an earn out, under which Oracle is

scheduled to make a single payment, if any, by November 30, 2014, to Pillar’s former shareholders based on an agreed-upon Earn-Out formula.

Plaintiffs seek declaratory relief, rescission of the Pillar Data transaction, damages, disgorgement of our Chief Executive Officer’s alleged

profits, disgorgement of all compensation earned by defendants as a result of their service on Oracle’

s Board or any committee of the Board, and

an award of attorneys’ fees and costs.

On June 13, 2014, plaintiffs and defendants filed a Stipulation and Agreement of Compromise, Settlement and Release, under which our Chief

Executive Officer agreed to pay to Oracle 95% of any and all amounts, if any, that are paid to him under the Pillar earn out. Oracle will pay

plaintiffs’ attorneys’ fees and costs, which will not exceed $15 million. The settlement is subject to approval by the Delaware Chancery Court,

which has scheduled a fairness hearing for August 12, 2014, at 10:00 a.m., Eastern Time.

While the outcome of the derivative litigation cannot be predicted with certainty, we do not believe that the outcome will result in losses that are

materially in excess of amounts already recognized, if any.

Other Litigation

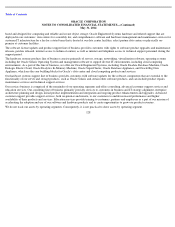

We are party to various other legal proceedings and claims, either asserted or unasserted, which arise in the ordinary course of business,

including proceedings and claims that relate to acquisitions we have completed or to companies we have acquired or are attempting to acquire.

While the outcome of these matters cannot be predicted with certainty, we do not believe that the outcome of any of these matters, individually

or in the aggregate, will result in losses that are materially in excess of amounts already recognized, if any.

133