Oracle 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

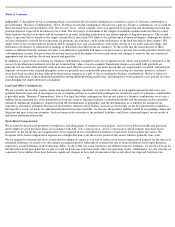

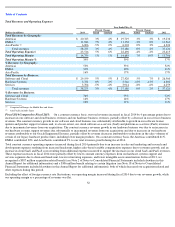

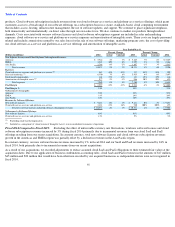

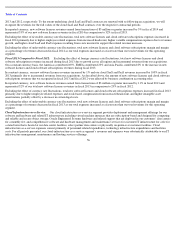

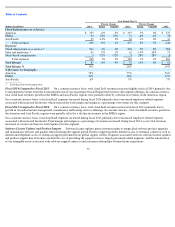

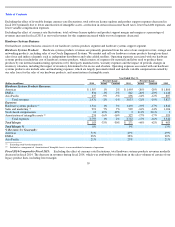

Total Revenues and Operating Expenses

Fiscal 2014 Compared to Fiscal 2013: On a constant currency basis, our total revenues increased in fiscal 2014 by 4 percentage points due to

increases in our software and cloud business revenues and our hardware business revenues, partially offset by a decrease in our services business

revenues. The constant currency growth in our software and cloud business was substantially attributable to growth in our software license

updates and product support revenues and, to a lesser extent, our cloud software-as-a-service (SaaS) and platform-as-a-service (PaaS) revenues

due to incremental revenues from our acquisitions. The constant currency revenues growth in our hardware business was due to an increase in

our hardware systems support revenues due substantially to incremental revenues from our acquisitions and due to increases in our hardware

revenues attributable to our Oracle Engineered Systems, partially offset by revenue decreases attributable to reductions in the sales volumes of

certain of our legacy hardware product lines, including lower margin products. On a constant currency basis, the Americas contributed 61%,

EMEA contributed 30% and Asia Pacific contributed 9% to our total revenues growth during fiscal 2014.

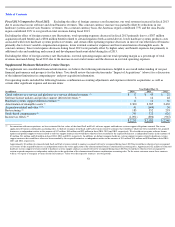

Total constant currency operating expenses increased during fiscal 2014 primarily due to an increase in sales and marketing and research and

development expenses resulting from increased headcount, higher sales-based variable compensation expenses due to revenues growth, and an

increase in cloud SaaS and PaaS costs resulting from additional expenses incurred to support the increases in our cloud SaaS and PaaS revenues.

These expense increases in fiscal 2014 were partially offset by lower constant currency expenses from our hardware systems support and

services segments due to decreased headcount, lower restructuring expenses, and lower intangible assets amortization. In fiscal 2013, we

recognized a $387 million acquisition related benefit (see Note 2 of Notes to Consolidated Financial Statements included elsewhere in this

Annual Report for additional information) and a $306 million benefit relating to certain litigation (see Note 18 of Notes to Consolidated

Financial Statements included elsewhere in this Annual Report for additional information), both of which decreased our acquisition related and

other expenses during this period.

Excluding the effect of foreign currency rate fluctuations, our operating margin increased during fiscal 2014 due to our revenues growth, while

our operating margin as a percentage of revenues was flat.

52

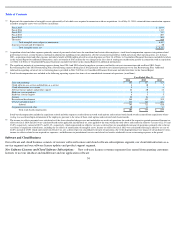

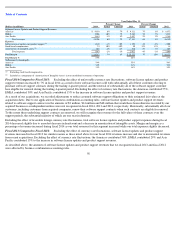

Year Ended May 31,

Percent Change

Percent Change

(Dollars in millions)

2014

Actual

Constant

2013

Actual

Constant

2012

Total Revenues by Geography:

Americas

$

20,323

3%

4%

$

19,719

3%

3%

$

19,236

EMEA

11,946

7%

4%

11,158

-

3%

0%

11,561

Asia Pacific

6,006

-

5%

2%

6,303

0%

3%

6,324

Total revenues

38,275

3%

4%

37,180

0%

2%

37,121

Total Operating Expenses

23,516

5%

6%

22,496

-

4%

-

2%

23,415

Total Operating Margin

$

14,759

1%

1%

$

14,684

7%

10%

$

13,706

Total Operating Margin %

39%

39%

37%

% Revenues by Geography:

Americas

53%

53%

52%

EMEA

31%

30%

31%

Asia Pacific

16%

17%

17%

Total Revenues by Business:

Software and Cloud

$

29,199

5%

5%

$

27,920

5%

7%

$

26,560

Hardware Systems

5,372

0%

2%

5,346

-

15%

-

13%

6,302

Services

3,704

-

5%

-

4%

3,914

-

8%

-

6%

4,259

Total revenues

$

38,275

3%

4%

$

37,180

0%

2%

$

37,121

% Revenues by Business:

Software and Cloud

76%

75%

72%

Hardware Systems

14%

14%

17%

Services

10%

11%

11%

Comprised of Europe, the Middle East and Africa

Asia Pacific includes Japan

(1)

(2)

(1)

(2)