Oracle 2013 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2014

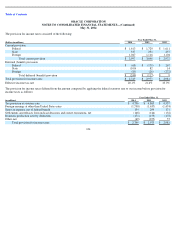

loss carryforwards and tax credit carryforwards. The amount of net deferred tax assets considered realizable is subject to adjustment in future

periods if estimates of future taxable income change.

The valuation allowance was $1.1 billion and $999 million at May 31, 2014 and 2013, respectively. Substantially all of the valuation allowances

as of May 31, 2014 and 2013 relate to tax assets established in purchase accounting. Any subsequent reduction of that portion of the valuation

allowance and the recognition of the associated tax benefits associated with our acquisitions will be recorded to our provision for income taxes

subsequent to our final determination of the valuation allowance or the conclusion of the measurement period (as defined above), whichever

comes first.

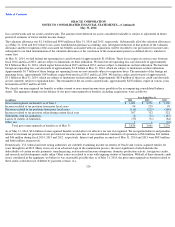

At May 31, 2014, we had federal net operating loss carryforwards of approximately $1.0 billion. These losses expire in various years between

fiscal 2016 and fiscal 2033, and are subject to limitations on their utilization. We had state net operating loss carryforwards of approximately

$2.8 billion at May 31, 2014, which expire between fiscal 2015 and fiscal 2033, and are subject to limitations on their utilization. We had total

foreign net operating loss carryforwards of approximately $1.8 billion at May 31, 2014, which are subject to limitations on their utilization.

Approximately $1.7 billion of these foreign net operating losses are not currently subject to expiration dates. The remainder of the foreign net

operating losses, approximately $143 million, expire between fiscal 2015 and fiscal 2034. We had tax credit carryforwards of approximately

$1.1 billion at May 31, 2014, which are subject to limitations on their utilization. Approximately $614 million of these tax credit carryforwards

are not currently subject to expiration dates. The remainder of the tax credit carryforwards, approximately $478 million, expire in various years

between fiscal 2015 and fiscal 2033.

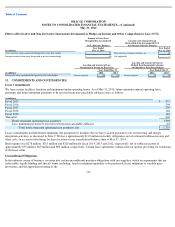

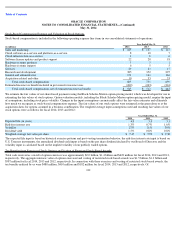

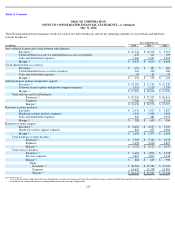

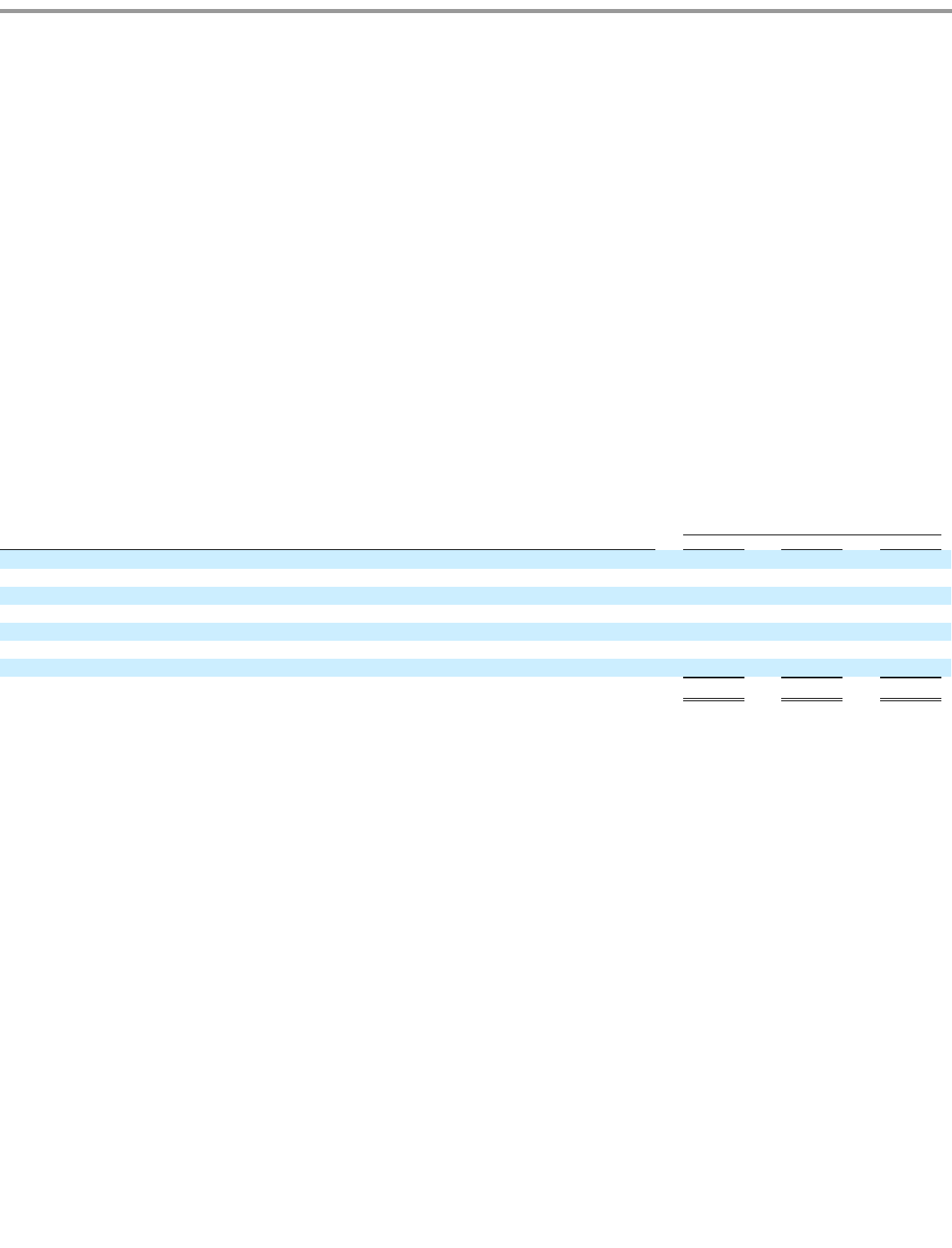

We classify our unrecognized tax benefits as either current or non-current income taxes payable in the accompanying consolidated balance

sheets. The aggregate changes in the balance of our gross unrecognized tax benefits, including acquisitions, were as follows:

As of May 31, 2014, $2.6 billion of unrecognized benefits would affect our effective tax rate if recognized. We recognized interest and penalties

related to uncertain tax positions in our provision for income taxes line of our consolidated statements of operations of $24 million, $31 million

and $46 million during fiscal 2014, 2013 and 2012, respectively. Interest and penalties accrued as of May 31, 2014 and 2013 were $693 million

and $666 million, respectively.

Domestically, U.S. federal and state taxing authorities are currently examining income tax returns of Oracle and various acquired entities for

years through fiscal 2013. Many issues are at an advanced stage in the examination process, the most significant of which include the

deductibility of certain royalty payments, transfer pricing, extraterritorial income exemptions, domestic production activity, foreign tax credits,

and research and development credits taken. Other issues are related to years with expiring statutes of limitation. With all of these domestic audit

issues considered in the aggregate, we believe it was reasonably possible that, as of May 31, 2014, the gross unrecognized tax benefits related to

these audits could decrease (whether by payment, release, or a

126

Year Ended May 31,

(in millions)

2014

2013

2012

Gross unrecognized tax benefits as of June 1

$

3,601

$

3,276

$

3,160

Increases related to tax positions from prior fiscal years

94

279

99

Decreases related to tax positions from prior fiscal years

(116

)

(125

)

(169

)

Increases related to tax positions taken during current fiscal year

307

312

522

Settlements with tax authorities

(2

)

(71

)

(187

)

Lapses of statutes of limitation

(53

)

(71

)

(84

)

Other, net

7

1

(65

)

Total gross unrecognized tax benefits as of May 31

$

3,838

$

3,601

$

3,276