Oracle 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

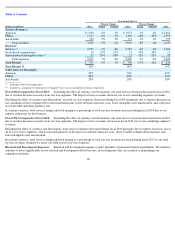

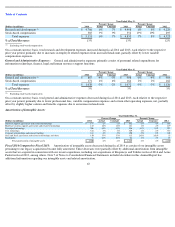

2013 and 2012, respectively. To the extent underlying cloud SaaS and PaaS contracts are renewed with us following an acquisition, we will

recognize the revenues for the full values of the cloud SaaS and PaaS contracts over the respective contractual periods.

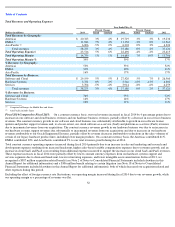

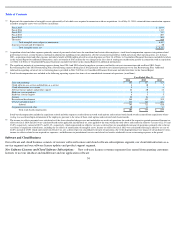

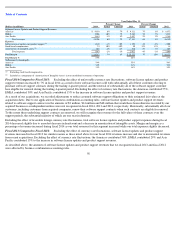

In reported currency, new software licenses revenues earned from transactions of $3 million or greater increased by 3% in fiscal 2014 and

represented 33% of our new software licenses revenues in fiscal 2014 in comparison to 32% in fiscal 2013.

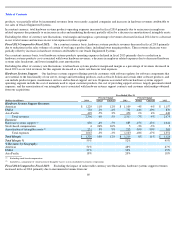

Excluding the effect of favorable currency rate fluctuations, total new software licenses and cloud software subscriptions expenses increased in

fiscal 2014 primarily due to higher employee related expenses from increased headcount, higher variable compensation expenses due to revenues

growth, and higher cloud SaaS and PaaS expenses resulting from costs incurred to support the related revenue increases.

Excluding the effect of unfavorable currency rate fluctuations, total new software licenses and cloud software subscriptions margin and margin

as a percentage of revenues decreased in fiscal 2014 as our total expenses increased at a faster rate than our total revenues for this operating

segment.

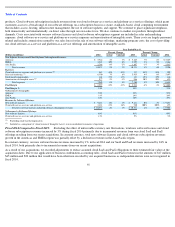

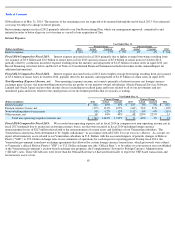

Fiscal 2013 Compared to Fiscal 2012: Excluding the effect of foreign currency rate fluctuations, total new software licenses and cloud

software subscriptions revenues increased during fiscal 2013 due to growth across all regions and incremental revenues from our acquisitions.

On a constant currency basis, the Americas contributed 69%, EMEA contributed 23% and Asia Pacific contributed 8% to the increase in new

software licenses and cloud software subscriptions revenues during fiscal 2013.

In constant currency, our new software licenses revenues increased by 1% and our cloud SaaS and PaaS revenues increased by 100% in fiscal

2013 primarily due to incremental revenues from our acquisitions. As described above, the amount of new software licenses and cloud software

subscriptions revenues that we recognized in fiscal 2013 and fiscal 2012 were affected by business combination accounting rules.

In reported currency, new software licenses revenues earned from transactions of $3 million or greater increased by 11% in fiscal 2013 and

represented 32% of our total new software licenses revenues in fiscal 2013 in comparison to 29% in fiscal 2012.

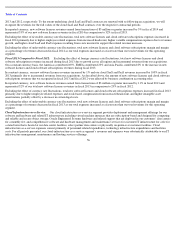

Excluding the effect of currency rate fluctuations, total new software licenses and cloud software subscriptions expenses increased in fiscal 2013

primarily due to higher employee related expenses and stock-based compensation from increased headcount, and higher intangible asset

amortization, partially offset by a decrease in certain legal costs.

Excluding the effect of unfavorable currency rate fluctuations, total new software licenses and cloud software subscriptions margin and margin

as a percentage of revenues decreased in fiscal 2013 as our total expenses increased at a faster rate than our total revenues for this operating

segment.

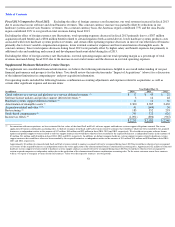

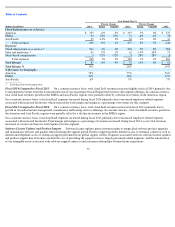

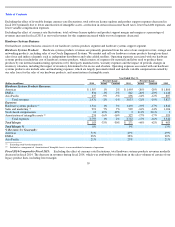

Cloud Infrastructure-as-a-Service: Our cloud infrastructure-as-a-service segment provides deployment and management offerings for our

software and hardware and related IT infrastructure including virtual machine instances that are subscription-based and designed for computing

and reliable and secure object storage; Oracle Engineered Systems hardware and related support that are deployed in our customers’ data centers

for a monthly fee; and comprehensive software and hardware management and maintenance services for customer IT infrastructure for a fee for

a stated term that is hosted at our data center facilities, select partner data centers or physically on-premise at customer facilities. Cloud

infrastructure-as-a-service expenses consist primarily of personnel related expenditures, technology infrastructure expenditures and facilities

costs. For all periods presented, our cloud-infrastructure-as-a-service segment’s revenues and expenses were substantially attributable to our IT

infrastructure management, maintenance and hosting services offerings.

56