Oracle 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2014

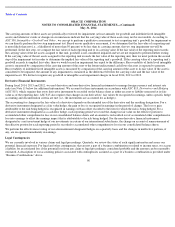

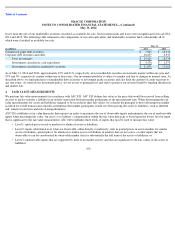

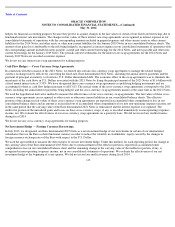

Assets Measured at Fair Value on a Recurring Basis

Our assets measured at fair value on a recurring basis, excluding accrued interest components, consisted of the following (Level 1 and 2 inputs

are defined above):

Our valuation techniques used to measure the fair values of our marketable securities that were classified as Level 1 in the table above were

derived from quoted market prices and active markets for these instruments exist. Our valuation techniques used to measure the fair values of

Level 2 instruments listed in the table above, the counterparties to which have high credit ratings, were derived from the following: non-binding

market consensus prices that are corroborated by observable market data, quoted market prices for similar instruments, or pricing models, such

as discounted cash flow techniques, with all significant inputs derived from or corroborated by observable market data including LIBOR-based

yield curves, among others.

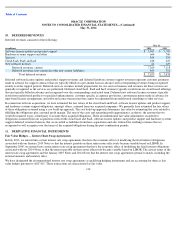

Based on the trading prices of our $24.2 billion and $18.5 billion of borrowings, which consisted of senior notes that were outstanding as of

May 31, 2014 and 2013, respectively, the estimated fair values of our borrowings using Level 2 inputs at May 31, 2014 and 2013 were $26.4

billion and $20.7 billion, respectively.

Inventories consisted of the following:

Property, plant and equipment, net consisted of the following:

107

May 31, 2014

May 31, 2013

Fair Value Measurements

Using Input Types

Fair Value Measurements

Using Input Types

(in millions)

Level 1

Level 2

Total

Level 1

Level 2

Total

Assets:

Commercial paper debt securities

$

—

$

7,969

$

7,969

$

—

$

14,043

$

14,043

Corporate debt securities and other

119

16,538

16,657

246

4,689

4,935

Derivative financial instruments

—

97

97

—

41

41

Total assets

$

119

$

24,604

$

24,723

$

246

$

18,773

$

19,019

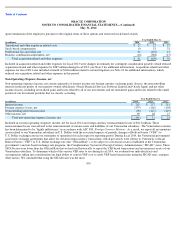

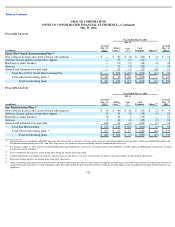

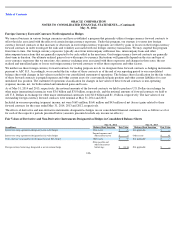

5.

INVENTORIES

May 31,

(in millions)

2014

2013

Raw materials

$

74

$

114

Work

-

in

-

process

28

31

Finished goods

87

95

Total

$

189

$

240

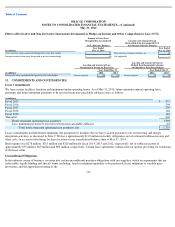

6.

PROPERTY, PLANT AND EQUIPMENT

Estimated

Useful Life

May 31,

(Dollars in millions)

2014

2013

Computer, network, machinery and equipment

1

-

5 years

$

2,468

$

2,138

Buildings and improvements

1

-

50 years

2,582

2,477

Furniture, fixtures and other

3

-

10 years

531

481

Land

—

632

632

Construction in progress

—

26

28

Total property, plant and equipment

1

-

50 years

6,239

5,756

Accumulated depreciation

(3,178

)

(2,703

)

Total property, plant and equipment, net

$

3,061

$

3,053