Oracle 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

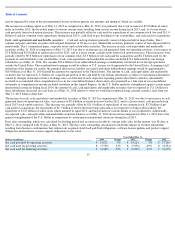

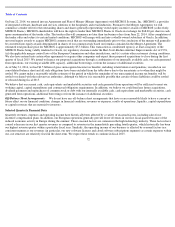

On June 22, 2014, we entered into an Agreement and Plan of Merger (Merger Agreement) with MICROS Systems, Inc. (MICROS), a provider

of integrated software, hardware and services solutions to the hospitality and retail industries. Pursuant to the Merger Agreement, we will

commence a tender offer for the outstanding shares and shares generally representing vested equity incentive awards of MICROS (collectively,

MICROS Shares). MICROS shareholders will have the right to tender their MICROS Shares to Oracle in exchange for $68.00 per share in cash

upon consummation of the tender offer. The tender offer will commence no later than ten business days from June 22, 2014. After completion of

the tender offer and subject to certain limited conditions, MICROS will merge with and into a wholly-owned subsidiary of Oracle. In addition,

unvested equity awards to acquire MICROS common stock that are outstanding immediately prior to the conclusion of the merger will generally

be converted into equity awards denominated in shares of our common stock based on formulas contained in the Merger Agreement. The

estimated total purchase price for MICROS is approximately $5.3 billion. This transaction is conditioned upon (i) at least a majority of the

MICROS Shares being validly tendered to Oracle, (ii) regulatory clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976,

(iii) the applicable merger control laws of the European Commission and other jurisdictions, and (iv) certain other customary closing conditions.

We also have entered into certain other agreements to acquire other companies and expect these proposed acquisitions to close during the first

quarter of fiscal 2015. We intend to finance our proposed acquisitions through a combination of our internally available cash, our cash generated

from operations, our existing available debt capacity, additional borrowings, or from the issuance of additional securities.

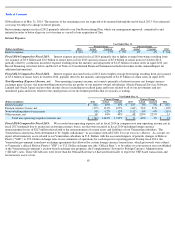

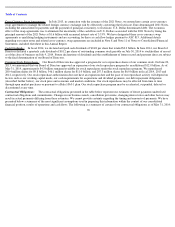

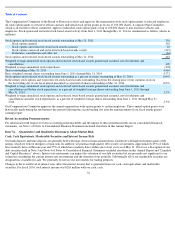

As of May 31, 2014, we had $4.5 billion of gross unrecognized income tax benefits, including related interest and penalties, recorded on our

consolidated balance sheet and all such obligations have been excluded from the table above due to the uncertainty as to when they might be

settled. We cannot make a reasonably reliable estimate of the period in which the remainder of our unrecognized income tax benefits will be

settled or released with the relevant tax authorities, although we believe it is reasonably possible that certain of these liabilities could be settled

or released during fiscal 2015.

We believe that our current cash, cash equivalents and marketable securities and cash generated from operations will be sufficient to meet our

working capital, capital expenditures and contractual obligation requirements. In addition, we believe we could fund any future acquisitions,

dividend payments and repurchases of common stock or debt with our internally available cash, cash equivalents and marketable securities, cash

generated from operations, additional borrowings or from the issuance of additional securities.

Off-Balance Sheet Arrangements: We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or

future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures

or capital resources that are material to investors.

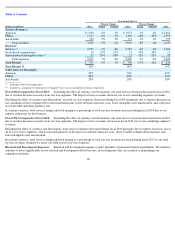

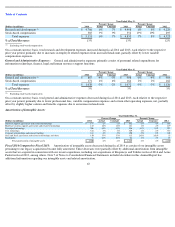

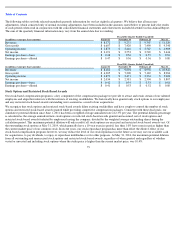

Selected Quarterly Financial Data

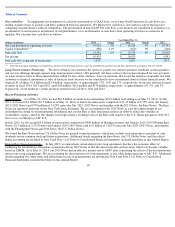

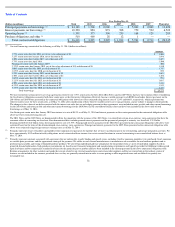

Quarterly revenues, expenses and operating income have historically been affected by a variety of seasonal factors, including sales force

incentive compensation plans. In addition, our European operations generally provide lower revenues in our first fiscal quarter because of the

reduced economic activity in Europe during the summer. These seasonal factors are common in the high technology industry. These factors have

caused a decrease in our first quarter revenues as compared to revenues in the immediately preceding fourth quarter, which historically has been

our highest revenue quarter within a particular fiscal year. Similarly, the operating income of our business is affected by seasonal factors in a

consistent manner as our revenues (in particular, our new software licenses and cloud software subscriptions segment) as certain expenses within

our cost structure are relatively fixed in the short-term. We expect these trends to continue in fiscal 2015.

72