Oracle 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

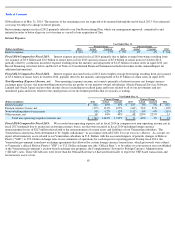

Cross Currency Swap Agreements : In July 2013, in connection with the issuance of the 2021 Notes, we entered into certain cross-currency

swap agreements to manage the related foreign currency exchange risk by effectively converting the fixed-rate, Euro denominated 2021 Notes,

including the annual interest payments and the payment of principal at maturity, to fixed-rate, U.S. Dollar denominated debt. The economic

effect of the swap agreements was to eliminate the uncertainty of the cash flows in U.S. Dollars associated with the 2021 Notes by fixing the

principal amount of the 2021 Notes at $1.6 billion with an annual interest rate of 3.53%. We have designated these cross-currency swap

agreements as qualifying hedging instruments and are accounting for these as cash flow hedges pursuant to ASC 815. Additional details

regarding our senior notes and related cross-currency swap agreements are included in Note 8 and Note 11 of Notes to Consolidated Financial

Statements, included elsewhere in this Annual Report.

Cash Dividends : In fiscal 2014, we declared and paid cash dividends of $0.48 per share that totaled $2.2 billion. In June 2014, our Board of

Directors declared a quarterly cash dividend of $0.12 per share of outstanding common stock payable on July 30, 2014 to stockholders of record

as of the close of business on July 9, 2014. Future declarations of dividends and the establishment of future record and payment dates are subject

to the final determination of our Board of Directors.

Common Stock Repurchases : Our Board of Directors has approved a program for us to repurchase shares of our common stock. On June 20,

2013, we announced that our Board of Directors approved an expansion of our stock repurchase program by an additional $12.0 billion. As of

May 31, 2014, approximately $4.3 billion remained available for stock repurchases under the stock repurchase program. We repurchased

280.4 million shares for $9.8 billion, 346.1 million shares for $11.0 billion, and 207.3 million shares for $6.0 billion in fiscal 2014, 2013 and

2012, respectively. Our stock repurchase authorization does not have an expiration date and the pace of our repurchase activity will depend on

factors such as our working capital needs, our cash requirements for acquisitions and dividend payments, our debt repayment obligations

(described further below), our stock price and economic and market conditions. Our stock repurchases may be effected from time to time

through open market purchases or pursuant to a Rule 10b5-1 plan. Our stock repurchase program may be accelerated, suspended, delayed or

discontinued at any time.

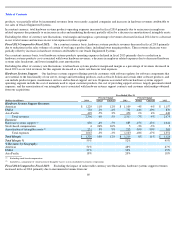

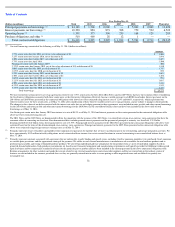

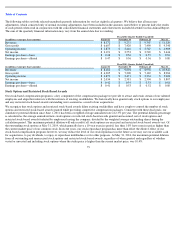

Contractual Obligations: The contractual obligations presented in the table below represent our estimates of future payments under fixed

contractual obligations and commitments. Changes in our business needs, cancellation provisions, changing interest rates and other factors may

result in actual payments differing from these estimates. We cannot provide certainty regarding the timing and amounts of payments. We have

presented below a summary of the most significant assumptions used in preparing this information within the context of our consolidated

financial position, results of operations and cash flows. The following is a summary of certain of our contractual obligations as of May 31, 2014:

70