Oracle 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

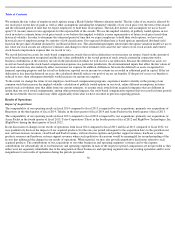

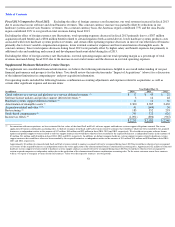

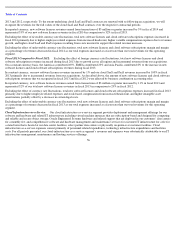

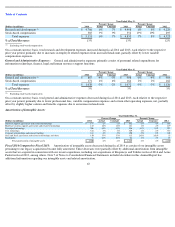

Fiscal 2014 Compared to Fiscal 2013: On a constant currency basis, total cloud IaaS revenues increased slightly in fiscal 2014 primarily due

to incremental revenues from the recent introduction of our on-premise Oracle Engineered Systems subscription offerings. In constant currency,

total cloud IaaS revenues growth in the EMEA and Asia Pacific regions were partially offset by a decline in revenues in the Americas region.

On a constant currency basis, total cloud IaaS expenses increased during fiscal 2014 primarily due to increased employee related expenses

associated with increased headcount, which reduced the total margin and margin as a percentage of revenues for this segment.

Fiscal 2013 Compared to Fiscal 2012: On a constant currency basis, total cloud IaaS revenues increased in fiscal 2013 primarily due to

growth in our infrastructure management, maintenance and hosting services offerings. In constant currency, total cloud IaaS revenues growth in

the Americas and Asia Pacific regions were partially offset by a decline in revenues in the EMEA region.

On a constant currency basis, total cloud IaaS expenses increased during fiscal 2013 primarily due to increased employee related expenses

associated with increased headcount. Total margin and margin as a percentage of revenues increased during fiscal 2013 as our total revenues

increased at a faster rate than our total expenses for this segment.

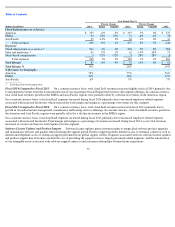

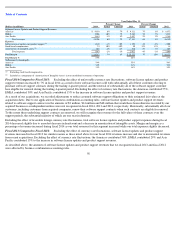

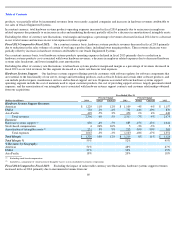

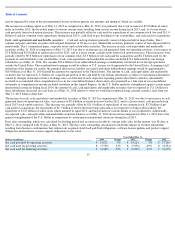

Software License Updates and Product Support:

Software license updates grant customers rights to unspecified software product upgrades

and maintenance releases and patches released during the support period. Product support includes internet access to technical content as well as

internet and telephone access to technical support personnel in our global support centers. Expenses associated with our software license updates

and product support line of business include the cost of providing the support services, largely personnel related expenses, and the amortization

of our intangible assets associated with software support contracts and customer relationships obtained from acquisitions.

57

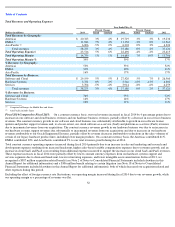

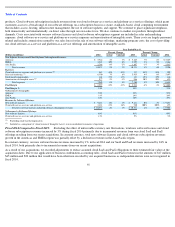

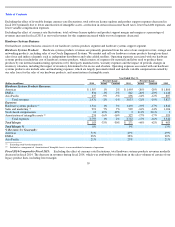

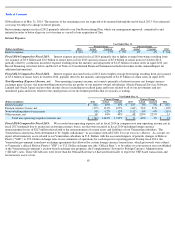

Year Ended May 31,

Percent Change

Percent Change

(Dollars in millions)

2014

Actual

Constant

2013

Actual

Constant

2012

Cloud Infastructure

-

as

-

a

-

Service:

Americas

$

335

-

6%

-

5%

$

355

5%

6%

$

337

EMEA

94

32%

27%

72

-

6%

-

1%

76

Asia Pacific

27

-

12%

3%

30

-

1%

4%

31

Total revenues

456

0%

1%

457

3%

5%

444

Expenses:

Cloud infastructure

-

as

-

a

-

service

304

3%

5%

296

5%

8%

283

Sales and marketing

61

0%

1%

61

-

15%

-

14%

72

Stock

-

based compensation

4

-

52%

-

52%

8

28%

28%

6

Total expenses

369

1%

3%

365

1%

4%

361

Total Margin

$

87

-

6%

-

9%

$

92

10%

8%

$

83

Total Margin %

19%

20%

19%

% Revenues by Geography:

Americas

73%

77%

76%

EMEA

21%

16%

17%

Asia Pacific

6%

7%

7%

Excluding stock

-

based compensation

(1)

(1)

(1)