Oracle 2013 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2014

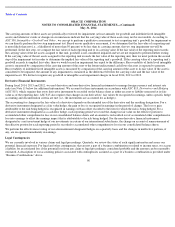

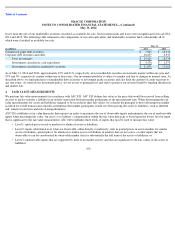

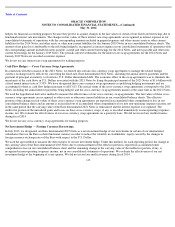

The changes in intangible assets for fiscal 2014 and the net book value of intangible assets at May 31, 2014 and 2013 were as follows:

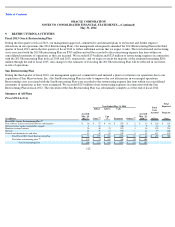

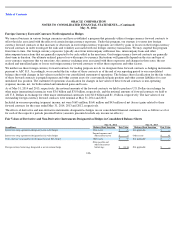

Total amortization expense related to our intangible assets was $2.3 billion in fiscal 2014 and $2.4 billion in each of fiscal 2013 and 2012. As of

May 31, 2014, estimated future amortization expenses related to intangible assets were as follows (in millions):

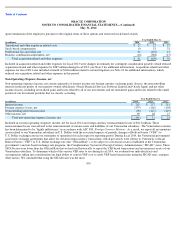

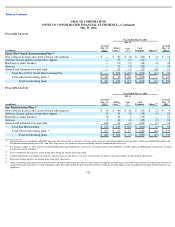

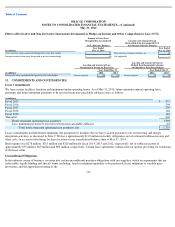

The changes in the carrying amounts of goodwill, which is generally not deductible for tax purposes, for our operating segments for fiscal 2014

and 2013 were as follows:

108

7.

INTANGIBLE ASSETS AND GOODWILL

Intangible Assets, Gross

Accumulated Amortization

Intangible Assets, Net

Weighted

Average

Useful Life

(Dollars in millions)

May 31,

2013

Additions

Retirements

May 31,

2014

May 31,

2013

Expense

Retirements

May 31,

2014

May 31,

2013

May 31,

2014

Software support agreements and related

relationships

$

5,298

$

—

$

(

80

)

$

5,218

$

(3,912

)

$

(571

)

$

80

$

(4,403

)

$

1,386

$

815

N.A.

Hardware systems support agreements and

related relationships

817

152

—

969

(387

)

(143

)

—

(

530

)

430

439

9 years

Developed technology

7,466

928

(4,007

)

4,387

(5,477

)

(706

)

4,007

(2,176

)

1,989

2,211

7 years

Core technology

2,579

—

(

962

)

1,617

(1,938

)

(318

)

962

(1,294

)

641

323

N.A.

Customer relationships and contract backlog

2,435

131

(512

)

2,054

(1,637

)

(334

)

512

(1,459

)

798

595

4 years

SaaS and PaaS agreements and related

relationships and other

1,227

562

—

1,789

(155

)

(150

)

—

(

305

)

1,072

1,484

10 years

Trademarks

635

39

(158

)

516

(356

)

(78

)

158

(276

)

279

240

10 years

Total intangible assets subject to

amortization

20,457

1,812

(5,719

)

16,550

(13,862

)

(2,300

)

5,719

(10,443

)

6,595

6,107

8 years

In

-

process research and development, net

45

(15

)

—

30

—

—

—

—

45

30

N.A.

Total intangible assets, net

$

20,502

$

1,797

$

(5,719

)

$

16,580

$

(13,862

)

$

(2,300

)

$

5,719

$

(10,443

)

$

6,640

$

6,137

Represents weighted average useful lives of intangible assets acquired during fiscal 2014.

Fiscal 2015

$

1,934

Fiscal 2016

1,337

Fiscal 2017

741

Fiscal 2018

607

Fiscal 2019

508

Thereafter

980

Total intangible assets subject to amortization

6,107

In

-

process research and development

30

Total intangible assets, net

$

6,137

(Dollars in millions)

New Software

Licenses and

Cloud

Software

Subscriptions

Software

License

Updates and

Product

Support

Hardware

Systems

Support

Other

Total

Balances as of May 31, 2012

$

7,367

$

12,479

$

1,193

$

4,080

$

25,119

Allocation of goodwill

2,346

—

—

(

2,346

)

—

Goodwill from acquisitions

933

27

62

1,341

2,363

Goodwill adjustments

(113

)

(32

)

4

2

(139

)

Balances as of May 31, 2013

10,533

12,474

1,259

3,077

27,343

Allocation of goodwill

875

—

380

(1,255

)

—

Goodwill from acquisitions

1,721

4

436

134

2,295

Goodwill adjustments

10

(6

)

7

3

14

Balances as of May 31, 2014

$

13,139

$

12,472

$

2,082

$

1,959

$

29,652

(1)

(1)

(3)

(1)

(2)

(1)

(2)