Oracle 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

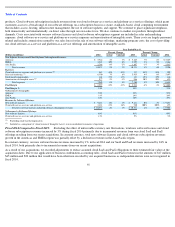

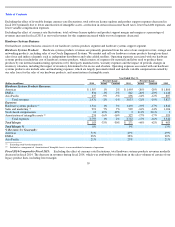

Fiscal 2014 Compared to Fiscal 2013: Excluding the effect of currency rate fluctuations, our total services revenues decreased in fiscal 2014

due to revenue decreases in each of our services segments. The largest services revenues decrease was to our consulting segment’s revenues.

Excluding the effect of currency rate fluctuations, our total services expenses decreased during fiscal 2014 primarily due to expense decreases in

our consulting services segment due to decreased headcount, lower external contractor costs, lower intangible asset amortization, and a decrease

in certain other operating expenses, net.

In constant currency, total services margin and total margin as a percentage of total services revenues increased during fiscal 2014 due to our

expense reductions for this business.

Fiscal 2013 Compared to Fiscal 2012: Excluding the effect of currency rate fluctuations, our total services revenues decreased in fiscal 2013

due to revenue decreases in each of our services segments. The largest services revenues decrease in fiscal 2013 was to our consulting segment’

s

revenues.

Excluding the effect of currency rate fluctuations, total services expenses decreased during fiscal 2013 primarily due to expense decreases across

all of our services segments, which consisted primarily of decreases in external contractor costs, lower variable compensation expenses, and

lower intangible asset amortization.

In constant currency, total services margin and total margin as a percentage of total services revenues decreased during fiscal 2013 as our total

services revenues declined at a faster rate than our total services expenses.

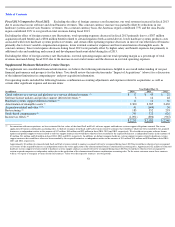

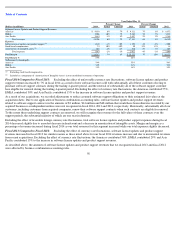

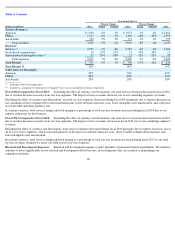

Research and Development Expenses:

Research and development expenses consist primarily of personnel related expenditures. We intend to

continue to invest significantly in our research and development efforts because, in our judgment, they are essential to maintaining our

competitive position.

62

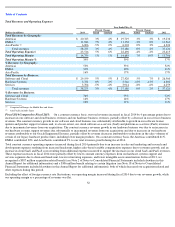

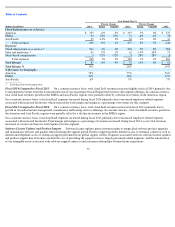

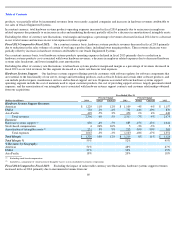

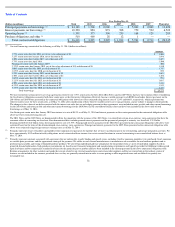

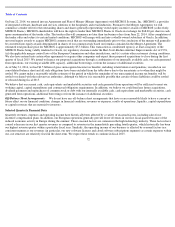

Year Ended May 31,

Percent Change

Percent Change

(Dollars in millions)

2014

Actual

Constant

2013

Actual

Constant

2012

Services Revenues:

Americas

$

1,850

-

6%

-

5%

$

1,973

-

5%

-

4%

$

2,083

EMEA

1,125

-

4%

-

7%

1,170

-

16%

-

13%

1,397

Asia Pacific

729

-

5%

2%

771

-

1%

4%

779

Total revenues

3,704

-

5%

-

4%

3,914

-

8%

-

6%

4,259

Expenses:

Services

2,925

-

7%

-

6%

3,159

-

6%

-

4%

3,365

Stock

-

based compensation

29

25%

25%

23

39%

39%

17

Amortization of intangible assets

17

-

26%

-

26%

23

-

52%

-

52%

47

Total expenses

2,971

-

7%

-

6%

3,205

-

7%

-

4%

3,429

Total Margin

$

733

3%

5%

$

709

-

15%

-

12%

$

830

Total Margin %

20%

18%

19%

% Revenues by Geography:

Americas

50%

50%

49%

EMEA

30%

30%

33%

Asia Pacific

20%

20%

18%

Excluding stock

-

based compensation

Included as a component of

‘

Amortization of Intangible Assets

’

in our consolidated statements of operations

(1)

(2)

(1)

(2)