Oracle 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2014

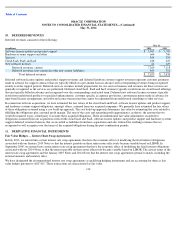

Acquisition of RightNow Technologies, Inc.

On January 25, 2012, we completed our acquisition of RightNow Technologies, Inc. (RightNow), a provider of cloud-based customer service.

We have included the financial results of RightNow in our consolidated financial statements from the date of acquisition. The total purchase

price for RightNow was approximately $1.5 billion, which consisted of approximately $1.5 billion in cash and $14 million for the fair value of

stock options and restricted stock-based awards assumed. We recorded $697 million of identifiable intangible assets and $259 million of net

tangible liabilities related primarily to customer performance obligations, convertible debt and deferred tax liabilities that were assumed as a part

of this acquisition, based on their estimated fair values, and $1.1 billion of residual goodwill.

Acquisition of Pillar Data Systems, Inc.

On July 18, 2011, we acquired Pillar Data Systems, Inc. (Pillar Data), a provider of enterprise storage systems solutions. Prior to the acquisition,

Pillar Data was directly and indirectly majority-owned and controlled by Lawrence J. Ellison, our Chief Executive Officer, director and largest

stockholder. Pursuant to the agreement and plan of merger dated as of June 29, 2011 (Pillar Data Merger Agreement), we acquired all of the

issued and outstanding equity interests of Pillar Data from the stockholders in exchange for rights to receive contingent cash consideration (Earn-

Out), if any, pursuant to an Earn-

Out calculation. An affiliate of Mr. Ellison has a preference right to receive the first approximately $565 million

of the Earn-Out, if any, and rights to 55% of any amount of the Earn-Out that exceeds $565 million.

The Earn-Out will be calculated with respect to a three-year period that commenced with our second quarter of fiscal 2012 and will conclude

with our first quarter of fiscal 2015 (Earn-Out Period). The Earn-Out will be an amount (if positive) calculated based on the product of (i) the

difference between (x) future revenues generated from the sale of certain Pillar Data products during Oracle’s last four full fiscal quarters during

the Earn-Out Period minus (y) certain losses associated with certain Pillar Data products incurred over the entire Earn-Out Period, multiplied by

(ii) three. Our obligation to pay the Earn-Out will be subject to reduction as a result of our right to set-off the amount of any indemnification

claims we may have under the Pillar Data Merger Agreement. We do not expect the amount of the Earn-Out or its potential impact will be

material to our results of operations or financial position.

We have included the financial results of Pillar Data in our consolidated financial statements from the date of acquisition. These results were not

material to our consolidated financial statements. The estimated fair value of the liability for contingent consideration as of the acquisition date,

representing the purchase price payable for our acquisition of Pillar Data, was approximately $346 million and was included in other non-

current

liabilities in our consolidated balance sheet. Our liability for contingent consideration payable is subject to change until the liability is settled

with the related impact recorded to our consolidated statements of operations as acquisition related and other expenses. In connection with our

acquisition of Pillar Data, we recorded $142 million of identifiable intangible assets and $16 million of net tangible liabilities, based on their

estimated fair values, and $220 million of residual goodwill. As of May 31, 2014 and 2013, we estimated the fair value of the Earn-Out liability

to be zero. We recorded a net benefit to acquisition related and other expenses of $387 million in fiscal 2013 to reduce the Earn-Out liability to

zero primarily as a result of a change in our estimate of year three revenues related to our acquisition of Pillar Data and the related impact to the

liability calculation in accordance with the Earn-Out formula as noted above.

In June 2014, Mr. Ellison agreed to pay to Oracle 95% of all amounts, if any, that are paid to him under the Earn-Out (see Note 18 below for

additional information).

Other Fiscal 2012 Acquisitions

During fiscal 2012, we acquired certain other companies and purchased certain technology and development assets primarily to expand our

products and services offerings. These acquisitions were not individually significant. We have included the financial results of these companies

in our consolidated financial statements

104