Oracle 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

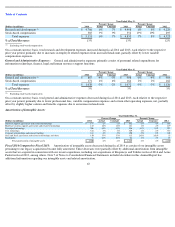

Table of Contents

$206 million as of May 31, 2014. The majority of the remaining costs are expected to be incurred through the end of fiscal 2015. Our estimated

costs may be subject to change in future periods.

Restructuring expenses in fiscal 2012 primarily related to our Sun Restructuring Plan, which our management approved, committed to and

initiated in order to better align our cost structure as a result of our acquisition of Sun.

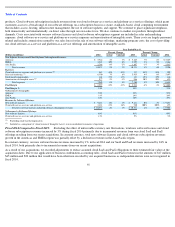

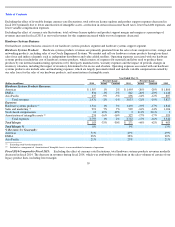

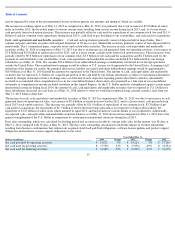

Interest Expense:

Fiscal 2014 Compared to Fiscal 2013: Interest expense increased in fiscal 2014 primarily due to higher average borrowings resulting from

our issuance of $3.0 billion and €2.0 billion of senior notes in July 2013 and our issuance of $5.0 billion of senior notes in October 2012,

partially offset by a reduction in interest expense resulting from the maturity and repayment of $1.25 billion of senior notes in April 2013 (see

Recent Financing Activities below and Note 8 of Notes to Consolidated Financial Statements included elsewhere in this Annual Report for

additional information).

Fiscal 2013 Compared to Fiscal 2012:

Interest expense increased in fiscal 2013 due to higher average borrowings resulting from our issuance

of $5.0 billion of senior notes in October 2012, partially offset by the maturity and repayment of $1.25 billion of senior notes in April 2013.

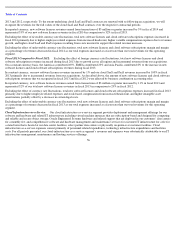

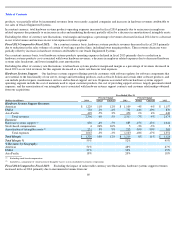

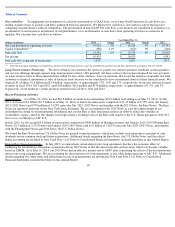

Non

-Operating (Expense) Income, net: Non-operating (expense) income, net consists primarily of interest income, net foreign currency

exchange gains (losses), the noncontrolling interests in the net profits of our majority-owned subsidiaries (Oracle Financial Services Software

Limited and Oracle Japan) and net other income (losses) including net realized gains and losses related to all of our investments and net

unrealized gains and losses related to the small portion of our investment portfolio that we classify as trading.

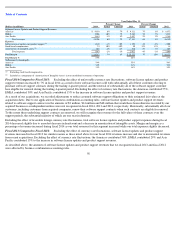

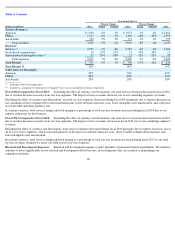

Fiscal 2014 Compared to Fiscal 2013: We recorded non-operating expense, net in fiscal 2014 in comparison to non-operating income, net in

fiscal 2013 primarily due to an increase in foreign currency losses, net that were incurred in fiscal 2014 including foreign currency

remeasurement losses of $213 million that related to the remeasurement of certain assets and liabilities of our Venezuelan subsidiary. The

Venezuelan economy has been determined to be “highly inflationary” in accordance with ASC 830, Foreign Currency Matters . As a result, we

report all net monetary assets related to our Venezuelan subsidiary in U.S. Dollars with the associated impacts of periodic changes of Bolivar

Fuerte (“VEF”) to U.S. Dollar exchange rates in our statements of operations for each respective reporting period. During fiscal 2014, the

Venezuelan government issued new exchange agreements that allowed for certain foreign currency transactions, which previously were subject

to Venezuela’s official Bolivar Fuerte (“VEF”) to U.S. Dollar exchange rate (the “Official Rate”),

to be subject to conversion at rates established

at the Venezuelan government’s auction-based exchange rate programs, the Complementary System for Foreign Currency Administration

(“SICAD”) rates. These SICAD rates were lower than the Official Rate that we had used historically to report the VEF based transactions and

net monetary assets of our

65

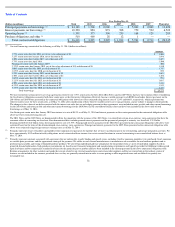

Year Ended May 31,

Percent Change

Percent Change

(Dollars in millions)

2014

Actual

Constant

2013

Actual

Constant

2012

Interest expense

$

914

15%

15%

$

797

4%

4%

$

766

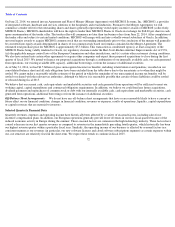

Year Ended May 31,

Percent Change

Percent Change

(Dollars in millions)

2014

Actual

Constant

2013

Actual

Constant

2012

Interest income

$

263

10%

17%

$

237

3%

7%

$

231

Foreign currency losses, net

(375

)

131%

127%

(162

)

54%

51%

(105

)

Noncontrolling interests in income

(98

)

-

12%

-

12%

(112

)

-

6%

-

4%

(119

)

Other income, net

69

44%

44%

48

220%

225%

15

Total non

-

operating (expense) income, net

$

(141

)

1,343%

1,749%

$

11

-

49%

4%

$

22