Oracle 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2014

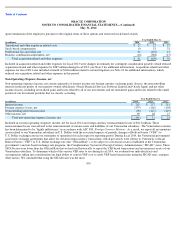

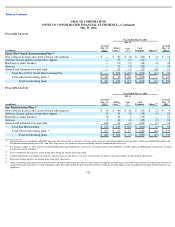

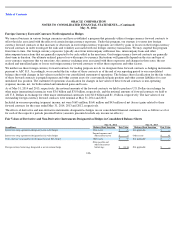

Notes payable and other borrowings consisted of the following:

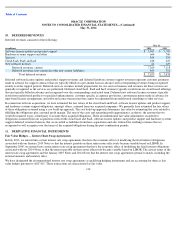

Senior Notes and Other

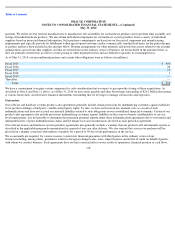

In July 2013, we issued €2.0 billion ($2.7 billion as of May 31, 2014) of fixed rate senior notes comprised of €1.25 billion of 2.25% notes due

January 2021 (2021 Notes) and €750 million of 3.125% notes due July 2025 (2025 Notes, and together with the 2021 Notes, the Euro Notes).

The Euro Notes are registered and trade on the New York Stock Exchange. We issued the Euro Notes for general corporate purposes, which may

include stock repurchases, payment of cash dividends on our common stock and future acquisitions.

In connection with the issuance of the 2021 Notes, we entered into certain cross-currency swap agreements that have the economic effect of

converting our fixed rate, Euro denominated debt, including annual interest payments and the payment of principal at maturity, to a fixed rate,

U.S. Dollar denominated debt of $1.6 billion with a fixed annual interest rate of 3.53% (see Note 11 for additional information). Further, we

designated the 2025 Notes as a net investment hedge of our investments in certain of our international subsidiaries that use the Euro as their

functional currency in order to reduce the volatility in stockholders’ equity caused by the changes in foreign currency exchange rates of the Euro

with respect to the U.S. Dollar. Refer to Note 11 for additional information.

In July 2013, we also issued $3.0 billion of senior notes comprised of $500 million of floating rate notes due January 2019 (2019 Floating Rate

Notes), $1.5 billion of 2.375% notes due January 2019 (January 2019 Notes) and $1.0 billion of 3.625%

109

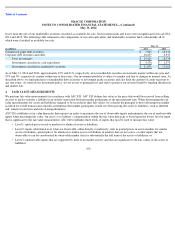

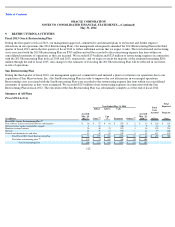

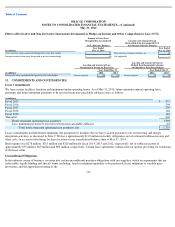

Represents the allocation of goodwill to our operating segments upon completion of our intangible asset valuations.

Pursuant to our business combinations accounting policy, we recorded goodwill adjustments for the effect on goodwill of changes to net assets acquired during the measurement period

(up to one year from the date of an acquisition). Goodwill adjustments were not significant to our previously reported operating results or financial position.

Represents goodwill allocated to our other operating segments and goodwill to be allocated to our operating segments upon completion of our intangible asset valuations, if any.

8. NOTES PAYABLE AND OTHER BORROWINGS

May 31,

(Dollars in millions)

2014

2013

3.75% senior notes due July 2014, net of fair value adjustments of $8 and $41 as of May 31, 2014 and 2013, respectively

$

1,508

$

1,541

5.25% senior notes due January 2016, net of discount of $2 and $3 as of May 31, 2014 and 2013, respectively

1,998

1,997

1.20% senior notes due October 2017, net of discount of $3 each as of May 31, 2014 and 2013

2,497

2,497

5.75% senior notes due April 2018, net of discount of $1 as of May 31, 2013

2,500

2,499

Floating rate senior notes due January 2019

500

—

2.375% senior notes due January 2019, net of fair value adjustment of $15 and discount of $5 as of May 31, 2014

1,510

—

5.00% senior notes due July 2019, net of discount of $3 and $4 as of May 31, 2014 and 2013, respectively

1,747

1,746

3.875% senior notes due July 2020, net of discount of $1 and $2 as of May 31, 2014 and 2013, respectively

999

998

2.25% senior notes due January 2021, net of discount of $9 as of May 31, 2014

1,691

—

2.50% senior notes due October 2022, net of discount of $2 each as of May 31, 2014 and 2013

2,498

2,498

3.625% senior notes due July 2023, net of discount of $8 as of May 31, 2014

992

—

3.125% senior notes due July 2025, net of discount of $3 as of May 31, 2014

1,017

—

6.50% senior notes due April 2038, net of discount of $2 each as of May 31, 2014 and 2013

1,248

1,248

6.125% senior notes due July 2039, net of discount of $7 each as of May 31, 2014 and 2013

1,243

1,243

5.375% senior notes due July 2040, net of discount of $23 and $24 as of May 31, 2014 and 2013, respectively

2,227

2,226

Capital leases

—

1

Total borrowings

$

24,175

$

18,494

Notes payable, current and other current borrowings

$

1,508

$

—

Notes payable, non

-

current and other non

-

current borrowings

$

22,667

$

18,494

Refer to Note 11 for a description of our accounting for fair value hedges.

Euro based notes valued at May 31, 2014 foreign exchange rates (see further discussion below)

(1)

(2)

(3)

(1)

(1)

(2)

(2)

(1)

(2)