Oracle 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2014

significant. We have included the financial results of these companies in our consolidated financial statements from their respective acquisition

dates and the results from each of these companies were not individually material to our consolidated financial statements. In the aggregate, the

total preliminary purchase price for these acquisitions was approximately $2.3 billion, which consisted primarily of cash consideration, and we

preliminarily recorded $213 million of net tangible liabilities, related primarily to deferred tax liabilities, $1.1 billion of identifiable intangible

assets, and $99 million of in-process research and development, based on their estimated fair values, and $1.3 billion of residual goodwill.

The preliminary fair value estimates for the assets acquired and liabilities assumed for our acquisitions completed during fiscal 2014 were based

upon preliminary calculations and valuations and our estimates and assumptions for each of these acquisitions are subject to change as we obtain

additional information for our estimates during the respective measurement periods (up to one year from the respective acquisition dates). The

primary areas of those preliminary estimates that were not yet finalized related to certain tangible assets and liabilities acquired, identifiable

intangible assets, certain legal matters and income and non-income based taxes.

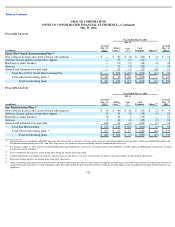

Fiscal 2013 Acquisitions

Acquisition of Acme Packet, Inc.

On March 28, 2013, we completed our acquisition of Acme Packet, Inc. (Acme Packet), a provider of session border control technology. We

have included the financial results of Acme Packet in our consolidated financial statements from the date of acquisition. The total purchase price

for Acme Packet was approximately $2.1 billion, which consisted of approximately $2.1 billion in cash and $12 million for the fair value of

stock options and restricted stock-based awards assumed. We have recorded $247 million of net tangible assets, $525 million of identifiable

intangible assets, and $45 million of in-process research and development, based on their estimated fair values, and $1.3 billion of residual

goodwill.

Acquisition of Eloqua, Inc.

On February 8, 2013, we completed our acquisition of Eloqua, Inc. (Eloqua), a provider of cloud-based marketing automation and revenue

performance management software. We have included the financial results of Eloqua in our consolidated financial statements from the date of

acquisition. The total purchase price for Eloqua was approximately $935 million, which consisted of approximately $933 million in cash and $2

million for the fair value of stock options assumed. We have recorded $1 million of net tangible assets and $327 million of identifiable intangible

assets, based on their estimated fair values, and $607 million of residual goodwill.

Other Fiscal 2013 Acquisitions

During fiscal 2013, we acquired certain other companies and purchased certain technology and development assets primarily to expand our

products and services offerings. These acquisitions were not significant individually or in the aggregate.

Fiscal 2012 Acquisitions

Acquisition of Taleo Corporation

On April 5, 2012, we completed our acquisition of Taleo Corporation (Taleo), a provider of cloud-based talent management solutions. We have

included the financial results of Taleo in our consolidated financial statements from the date of acquisition. The total purchase price for Taleo

was approximately $2.0 billion, which consisted of approximately $2.0 billion in cash and $10 million for the fair value of stock options and

restricted stock-based awards assumed. We recorded $1.1 billion of identifiable intangible assets and $244 million of net tangible liabilities

related primarily to deferred tax liabilities and customer performance obligations that were assumed as a part of this acquisition, based on their

estimated fair values, and $1.1 billion of residual goodwill.

103