Oracle 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Venezuelan subsidiary. To determine which of the various VEF rates to use during fiscal 2014, we evaluated our individual facts and

circumstances taking into consideration our legal ability to convert VEF at or to settle VEF based transactions using the SICAD rates, amongst

other factors. We concluded that using the SICAD rates was the most appropriate for our reporting of our Venezuelan subsidiary’s VEF based

transactions and net monetary assets in U.S. Dollars, which resulted in the $213 million of fiscal 2014 remeasurement losses referenced above.

Future devaluations of the Venezuelan currency are not expected to have a significant impact on our consolidated financial statements. As a

large portion of our consolidated operations are international, we could experience additional foreign currency volatility and incur additional

remeasurement losses in the future, the amounts and timing of which are unknown.

Fiscal 2013 Compared to Fiscal 2012: On a constant currency basis, our non-operating income, net decreased in fiscal 2013 primarily due to

an increase in foreign currency transaction losses, net, that included a foreign currency loss relating to our Venezuelan subsidiary’s operations.

During our third quarter of fiscal 2013, the Venezuelan government devalued its currency and we recognized a $64 million foreign currency loss

as a result of the remeasurement of certain assets and liabilities of our Venezuelan subsidiary. This decrease in non-operating income, net was

partially offset by an increase in other income, net during fiscal 2013, which was primarily due to gains from our marketable securities that we

designated as trading that were held to support our deferred compensation plan obligations.

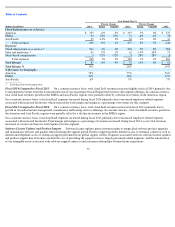

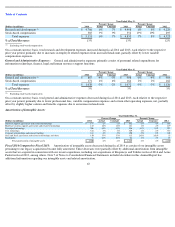

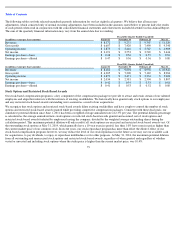

Provision for Income Taxes:

Our effective tax rate in all periods is the result of the mix of income earned in various tax jurisdictions that

apply a broad range of income tax rates. The provision for income taxes differs from the tax computed at the U.S. federal statutory income tax

rate due primarily to earnings considered as indefinitely reinvested in foreign operations, state taxes, the U.S. research and development tax

credit and the U.S. domestic production activity deduction. Future effective tax rates could be adversely affected if earnings are lower than

anticipated in countries where we have lower statutory tax rates, by unfavorable changes in tax laws and regulations or by adverse rulings in tax

related litigation.

Fiscal 2014 Compared to Fiscal 2013:

Provision for income taxes in fiscal 2014 decreased, relative to the provision for income taxes in fiscal

2013, due to a tax favorable change in the jurisdictional mix of our earnings and the effects of acquisition related settlements with tax authorities

during fiscal 2014.

Fiscal 2013 Compared to Fiscal 2012: Provision for income taxes in fiscal 2013 decreased slightly due to acquisition related items, the

retroactive extension of the U.S. research and development credit, offset by higher income before provision for income taxes.

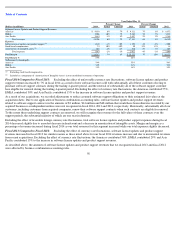

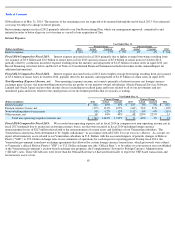

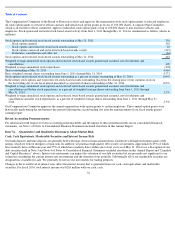

Liquidity and Capital Resources

Working capital: The increase in working capital as of May 31, 2014 in comparison to May 31, 2013 was primarily due to our issuance of

€

2.0 billion and $3.0 billion of long-term senior notes in July 2013, the favorable impact to our net current assets resulting from our net income

during fiscal 2014, and, to a lesser extent, cash proceeds from stock option exercises. These working capital increases were partially offset by the

reclassification of $1.5 billion of senior notes due July 2014 from long-term to current, cash used for repurchases of our common stock (we used

$9.8 billion of cash for common stock repurchases during fiscal 2014), cash used to pay dividends to our stockholders, and cash used for

acquisitions, all of which occurred during fiscal 2014. Our working capital

66

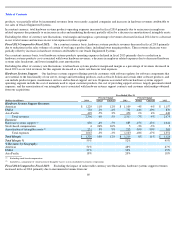

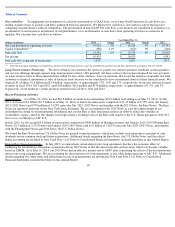

Year Ended May 31,

Percent Change

Percent Change

(Dollars in millions)

2014

Actual

Constant

2013

Actual

Constant

2012

Provision for income taxes

$

2,749

-

7%

-

6%

$

2,973

0%

3%

$

2,981

Effective tax rate

20.1%

21.4%

23.0%

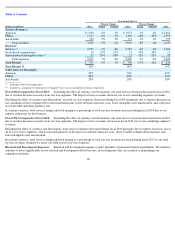

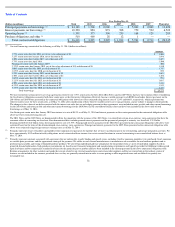

As of May 31,

(Dollars in millions)

2014

Change

2013

Change

2012

Working capital

$

33,749

17%

$

28,820

17%

$

24,635

Cash, cash equivalents and marketable securities

$

38,819

20%

$

32,216

5%

$

30,676