Oracle 2013 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2014

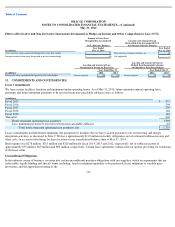

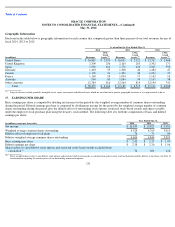

the total tax benefits received, we classified excess tax benefits from stock-

based compensation of $250 million, $241 million and $97 million as

cash flows from financing activities rather than cash flows from operating activities for fiscal 2014, 2013 and 2012, respectively.

Employee Stock Purchase Plan

We have an Employee Stock Purchase Plan (Purchase Plan) that allows employees to purchase shares of common stock at a price per share that

is 95% of the fair market value of Oracle stock as of the end of the semi-annual option period. As of May 31, 2014, 60 million shares were

reserved for future issuances under the Purchase Plan. We issued 3 million shares under the Purchase Plan in each of fiscal 2014 and 2013 and

4 million shares in fiscal 2012.

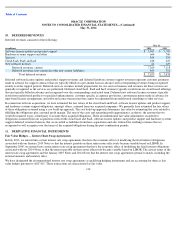

Defined Contribution and Other Postretirement Plans

We offer various defined contribution plans for our U.S. and non-U.S. employees. Total defined contribution plan expense was $357 million,

$353 million and $344 million for fiscal 2014, 2013 and 2012, respectively. The number of plan participants in our benefit plans has generally

increased in recent years primarily as a result of additional eligible employees from our acquisitions.

In the United States, regular employees can participate in the Oracle Corporation 401(k) Savings and Investment Plan (Oracle 401(k) Plan).

Participants can generally contribute up to 40% of their eligible compensation on a per-pay-period basis as defined by the Oracle 401(k) Plan

document or by the section 402(g) limit as defined by the United States Internal Revenue Service (IRS). We match a portion of employee

contributions, currently 50% up to 6% of compensation each pay period, subject to maximum aggregate matching amounts. Our contributions to

the Oracle 401(k) Plan, net of forfeitures, were $134 million, $129 million and $125 million in fiscal 2014, 2013 and 2012, respectively.

We also offer non-qualified deferred compensation plans to certain key employees whereby they may defer a portion of their annual base and/or

variable compensation until retirement or a date specified by the employee in accordance with the plans. Deferred compensation plan assets and

liabilities were each approximately $367 million as of May 31, 2014 and were each approximately $320 million as of May 31, 2013 and were

presented in other assets and other non-current liabilities in the accompanying consolidated balance sheets.

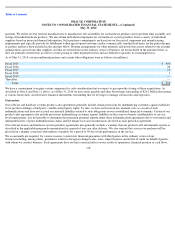

We sponsor certain defined benefit pension plans that are offered primarily by certain of our foreign subsidiaries. Many of these plans were

assumed through our acquisitions or are required by local regulatory requirements. We may deposit funds for these plans with insurance

companies, third party trustees, or into government-managed accounts consistent with local regulatory requirements, as applicable. Our total

defined benefit plan pension expenses were $64 million, $81 million and $55 million for fiscal 2014, 2013 and 2012, respectively. The aggregate

projected benefit obligation and aggregate net liability (funded status) of our defined benefit plans as of May 31, 2014 was $853 million and

$436 million, respectively, and as of May 31, 2013 was $734 million and $364 million, respectively.

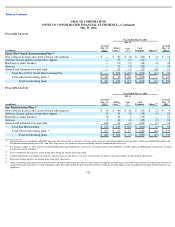

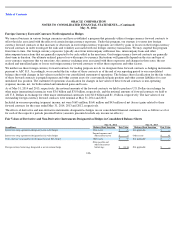

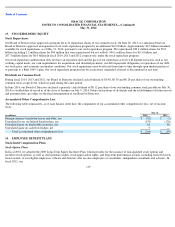

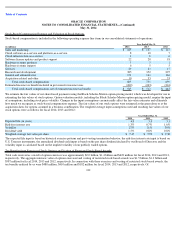

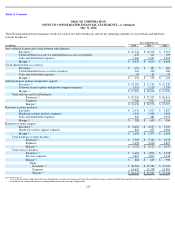

The following is a geographical breakdown of income before the provision for income taxes:

123

15.

INCOME TAXES

Year Ended May 31,

(in millions)

2014

2013

2012

Domestic

$

5,397

$

6,614

$

6,284

Foreign

8,307

7,284

6,678

Income before provision for income taxes

$

13,704

$

13,898

$

12,962