Oracle 2013 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2013 Oracle annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ORACLE CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

May 31, 2014

In the third quarter of fiscal 2012, shortly after the closing of our acquisition of RightNow, we repaid, in full, $255 million of RightNow’

s legacy

convertible notes.

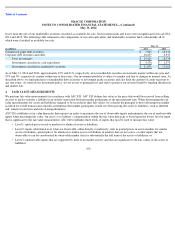

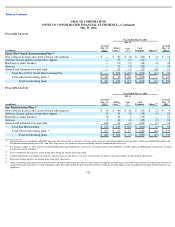

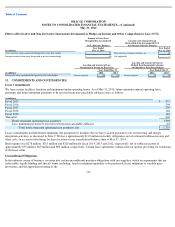

Future principal payments for all of our borrowings at May 31, 2014 were as follows (in millions):

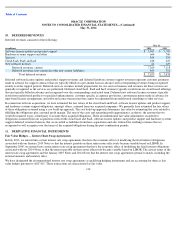

Commercial Paper Program and Commercial Paper Notes

On April 22, 2013, pursuant to our existing $3.0 billion commercial paper program which allows us to issue and sell unsecured short-term

promissory notes pursuant to a private placement exemption from the registration requirements under federal and state securities laws, we

entered into new dealer agreements with various banks and a new Issuing and Paying Agency Agreement with JP Morgan Chase Bank, N.A. As

of May 31, 2014 and 2013, we did not have any outstanding commercial paper notes. We intend to back-stop any commercial paper notes that

we may issue in the future with the 2013 Credit Agreement (see additional details below).

Revolving Credit Agreements

In April 2013, we entered into a $3.0 billion Revolving Credit Agreement with Wells Fargo Bank, N.A., Bank of America, N.A., BNP Paribas,

JPMorgan Chase Bank, N.A. and certain other lenders (the 2013 Credit Agreement). The 2013 Credit Agreement provides for an unsecured 5-

year revolving credit facility to be used for general corporate purposes including back

-stopping any commercial paper notes that we may issue.

Subject to certain conditions stated in the 2013 Credit Agreement, we may borrow, prepay and re-borrow amounts under the 2013 Credit

Agreement at any time during the term of the 2013 Credit Agreement. Interest under the 2013 Credit Agreement is based on either (a) a LIBOR-

based formula or (b) the Base Rate formula, each as set forth in the 2013 Credit Agreement. Any amounts drawn pursuant to the 2013 Credit

Agreement are due on April 20, 2018. No amounts were outstanding pursuant to the 2013 Credit Agreement as of May 31, 2014 and 2013.

The 2013 Credit Agreement contains certain customary representations and warranties, covenants and events of default, including the

requirement that our total net debt to total capitalization ratio not exceed 45% on a consolidated basis. If any of the events of default occur and

are not cured within applicable grace periods or waived, any unpaid amounts under the 2013 Credit Agreement may be declared immediately

due and payable and the 2013 Credit Agreement may be terminated. We were in compliance with the 2013 Credit Agreement’s covenants as of

May 31, 2014.

On May 29, 2012, we borrowed $1.7 billion pursuant to a revolving credit agreement with JPMorgan Chase Bank, N.A., as initial lender and

administrative agent; and J.P. Morgan Securities, LLC, as sole lead arranger and sole bookrunner (the 2012 Credit Agreement). During fiscal

2013, we repaid the $1.7 billion and the 2012 Credit Agreement expired pursuant to its terms.

On May 27, 2011, we entered into two revolving credit agreements with BNP Paribas, as initial lender and administrative agent, and BNP

Paribas Securities Corp., as sole lead arranger and sole bookrunner (the 2011 Credit Agreements), and borrowed $1.15 billion pursuant to these

agreements. During fiscal 2012, we repaid the $1.15 billion and the 2011 Credit Agreements expired pursuant to their terms.

111

Fiscal 2015

$

1,500

Fiscal 2016

2,000

Fiscal 2017

—

Fiscal 2018

5,000

Fiscal 2019

2,000

Thereafter

13,620

Total

$

24,120