NetFlix 2013 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2013 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

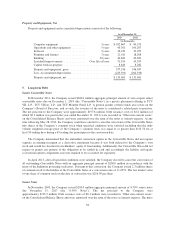

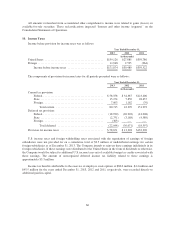

recognized, would favorably impact the Company’s effective tax rate. The aggregate changes in the Company’s

total gross amount of unrecognized tax benefits are summarized as follows (in thousands):

Balance as of December 31, 2011 .............................................. $28,133

Increases related to tax positions taken during prior periods ...................... 8,487

Decreases related to tax positions taken during prior periods ..................... (320)

Increases related to tax positions taken during the current period .................. 7,037

Balance as of December 31, 2012 .............................................. $43,337

Increases related to tax positions taken during prior periods ...................... 4

Decreases related to tax positions taken during prior periods ..................... (25)

Increases related to tax positions taken during the current period .................. 24,915

Balance as of December 31, 2013 .............................................. $68,231

The Company includes interest and penalties related to unrecognized tax benefits within the provision for

income taxes. As of December 31, 2013 and December 31, 2012, the total amount of gross interest and penalties

accrued was $3.9 million and $3.1 million, respectively, which is classified as “Other non-current liabilities” in

the Consolidated Balance Sheets. Interest and penalties included in our provision for income taxes were not

material in all the periods presented.

The Company files U.S. federal, state and foreign tax returns. The Company is currently under examination

by the IRS for the years 2008 through 2011. The IRS has completed its Field Exam of the 2008 and 2009 federal

tax returns and has issued a Revenue Agents Report with a proposed assessment primarily related to our R&D

Credits claimed in those years. We have filed a protest against the proposed assessment and are currently

awaiting the commencement of the IRS Appeals process. The IRS Field Exam of the 2010 and 2011 federal tax

returns is still underway. The year 2012 remains subject to examination by the IRS.

The Company is also currently under examination by the state of California for the years 2006 and 2007.

California has completed its Field Exam of the 2006 and 2007 California tax returns and has issued a Notice of

Proposed Assessment primarily related to our R&D Credits claimed in those years. We have filed a protest

against the proposed assessment and are currently awaiting the commencement of the Protest process with the

Franchise Tax Board. The years 1997 through 2005, as well as 2008 through 2012, remain subject to examination

by the state of California.

The Company is currently not under examination in any foreign jurisdiction. The years 2011 and 2012

remain subject to examination by foreign jurisdictions.

Given the potential outcome of the current examinations as well as the impact of the current examinations

on the potential expiration of the statute of limitations, it is reasonably possible that the balance of unrecognized

tax benefits could significantly change within the next twelve months. However, at this time, an estimate of the

range of reasonably possible adjustments to the balance of unrecognized tax benefits cannot be made.

11. Employee Benefit Plan

The Company maintains a 401(k) savings plan covering substantially all of its employees. Eligible

employees may contribute up to 60% of their annual salary through payroll deductions, but not more than the

statutory limits set by the Internal Revenue Service. The Company matches employee contributions at the

discretion of the Board. During 2013, 2012 and 2011, the Company’s matching contributions totaled $6.5

million, $5.2 million and $4.0 million, respectively.

68