NetFlix 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

All amounts reclassified from accumulated other comprehensive income were related to gains (losses) on

available-for-sale securities. These reclassifications impacted “Interest and other income (expense)” on the

Consolidated Statements of Operations.

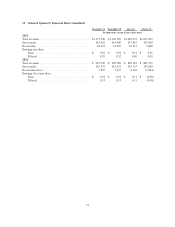

10. Income Taxes

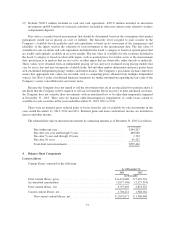

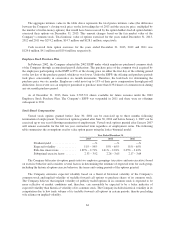

Income before provision for income taxes was as follows:

Year Ended December 31,

2013 2012 2011

(in thousands)

United States ......................................... $159,126 $27,885 $359,786

Foreign .............................................. 11,948 2,595 (264)

Income before income taxes ......................... $171,074 $30,480 $359,522

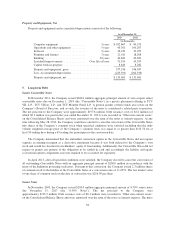

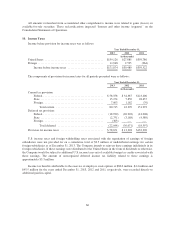

The components of provision for income taxes for all periods presented were as follows:

Year Ended December 31,

2013 2012 2011

(in thousands)

Current tax provision:

Federal .......................................... $58,558 $ 34,387 $123,406

State ............................................ 15,154 7,850 28,657

Foreign .......................................... 7,003 1,162 (70)

Total current ................................. 80,715 43,399 151,993

Deferred tax provision:

Federal .......................................... (18,930) (26,903) (14,008)

State ............................................ (2,751) (3,168) (4,589)

Foreign .......................................... (363) — —

Total deferred ................................ (22,044) (30,071) (18,597)

Provision for income taxes .............................. $58,671 $ 13,328 $133,396

U.S. income taxes and foreign withholding taxes associated with the repatriation of earnings of foreign

subsidiaries were not provided for on a cumulative total of $9.5 million of undistributed earnings for certain

foreign subsidiaries as of December 31, 2013. The Company intends to reinvest these earnings indefinitely in its

foreign subsidiaries. If these earnings were distributed to the United States in the form of dividends or otherwise,

the Company would be subject to additional U.S. income taxes net of available foreign tax credits associated with

these earnings. The amount of unrecognized deferred income tax liability related to these earnings is

approximately $3.3 million.

Income tax benefits attributable to the exercise of employee stock options of $80.0 million, $4.4 million and

$45.5 million for the years ended December 31, 2013, 2012 and 2011, respectively, were recorded directly to

additional paid-in-capital.

66