NetFlix 2013 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2013 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

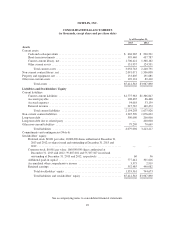

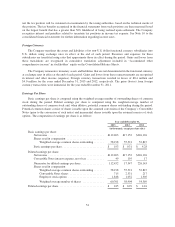

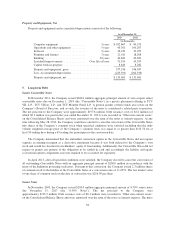

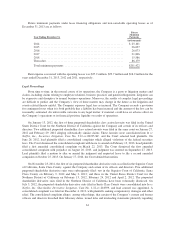

Property and Equipment, Net

Property and equipment and accumulated depreciation consisted of the following:

As of December 31,

2013 2012

(in thousands)

Computer equipment ................... 3years $ 102,867 $ 84,193

Operations and other equipment .......... 5years 96,361 100,207

Software ............................ 3years 36,439 39,073

Furniture and fixtures .................. 3years 21,011 18,208

Building ............................ 30years 40,681 40,681

Leasehold improvements ............... Over life of lease 51,194 45,393

Capital work-in-progress ................................ 8,643 8,282

Property and equipment, gross ............................ 357,196 336,037

Less: Accumulated depreciation ........................... (223,591) (204,356)

Property and equipment, net .............................. $133,605 $ 131,681

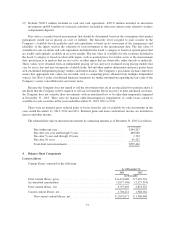

5. Long-term Debt

Senior Convertible Notes

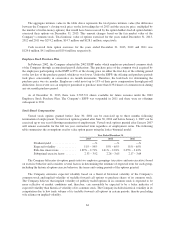

In November 2011, the Company issued $200.0 million aggregate principal amount of zero coupon senior

convertible notes due on December 1, 2018 (the “Convertible Notes”) in a private placement offering to TCV

VII, L.P., TCV VII(A), L.P., and TCV Member Fund, L.P. A general partner of these funds also serves on the

Company’s Board of Directors, and as such, the issuance of the notes is considered a related party transaction.

The net proceeds to the Company were approximately $197.8 million. Debt issuance costs of $2.2 million (of

which $0.3 million was paid in the year ended December 31, 2012) were recorded in “Other non-current assets”

on the Consolidated Balance Sheets and were amortized over the term of the notes as interest expense. At any

time following May 28, 2012, the Company could have elected to cause the conversion of the Convertible Notes

into shares of the Company’s common stock when specified conditions were satisfied, including that the daily

volume weighted average price of the Company’s common stock was equal to or greater than $111.54 for at

least 50 trading days during a 65 trading day period prior to the conversion date.

The Company determined that the embedded conversion option in the Convertible Notes did not require

separate accounting treatment as a derivative instrument because it was both indexed to the Company’s own

stock and would be classified in stockholders’ equity if freestanding. Additionally, the Convertible Notes did not

require or permit any portion of the obligation to be settled in cash and accordingly the liability and equity

(conversion option) components were not required to be accounted for separately.

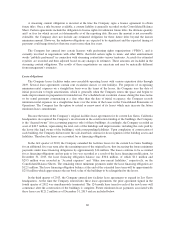

In April 2013, after all specified conditions were satisfied, the Company elected to cause the conversion of

all outstanding Convertible Notes with an aggregate principal amount of $200.0 million in accordance with the

terms of the Indenture governing such notes. Pursuant to this conversion, the Company issued 2.3 million shares

of common stock to the holders of the Convertible Notes at a conversion ratio of 11.6553. The fair market value

of one share of common stock on the date of conversion was $216.99 per share.

Senior Notes

In November 2009, the Company issued $200.0 million aggregate principal amount of 8.50% senior notes

due November 15, 2017 (the “8.50% Notes”). The net proceeds to the Company were

approximately $193.9 million. Debt issuance costs of $6.1 million were recorded in “Other non-current assets”

on the Consolidated Balance Sheets and were amortized over the term of the notes as interest expense. The notes

58