NetFlix 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

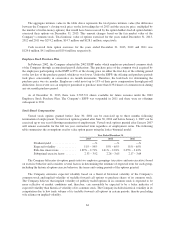

In valuing shares issued under the Company’s employee stock option plans, the Company bases the risk-free

interest rate on U.S. Treasury zero-coupon issues with terms similar to the contractual term of the options. The

Company does not anticipate paying any cash dividends in the foreseeable future and therefore uses an expected

dividend yield of zero in the option valuation model. The Company does not use a post-vesting termination rate

as options are fully vested upon grant date. The weighted-average fair value of employee stock options granted

during 2013, 2012 and 2011 was $113.74, $41.00 and $84.94 per share, respectively.

Stock-based compensation expense related to stock option plans was $73.1 million, $73.9 million and

$61.6 million for the years ended December 31, 2013, 2012 and 2011, respectively. The total income tax benefit

recognized in the income statement related to stock option plans was $28.1 million, $28.5 million and

$22.8 million for 2013, 2012 and 2011, respectively.

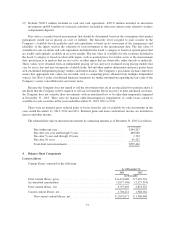

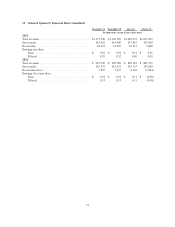

Stock Repurchase Program

The following table presents a summary of the Company’s stock repurchases for the year ended

December 31, 2011 (in thousands, except per share data):

Total number of shares repurchased .................................... 900

Dollar amount of shares repurchased ................................... $ 199,666

Average price paid per share .......................................... $ 221.88

Range of price paid per share ......................................... $160.11 – $248.78

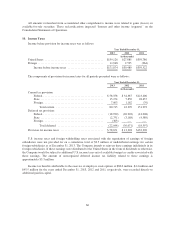

Under the stock repurchase plan announced on June 11, 2010, the Company was authorized to repurchase up

to $300 million of its common stock through the end of 2012. As of December 31, 2012, the Company has

repurchased $259.0 million of its common stock under this plan. As of December 31, 2012, the plan has expired

and the remaining $41.0 million was unused.

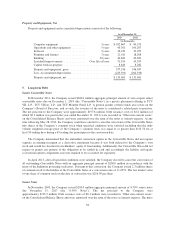

9. Accumulated Other Comprehensive Income

The following table summarizes the changes in accumulated balances of other comprehensive income (loss),

net of tax:

Foreign

currency

Change in

unrealized gains

on available for

sale securities Total

(in thousands)

Balance as of December 31, 2011 ........................ $ 24 $ 682 $ 706

Other comprehensive income before reclassifications .... 1,357 1,275 2,632

Amounts reclassified from accumulated other

comprehensive income .......................... — (419) (419)

Net increase in other comprehensive income ....... 1,357 856 2,213

Balance as of December 31, 2012 ........................ $1,381 $ 1,538 $2,919

Other comprehensive income before reclassifications .... 1,772 (1,597) 175

Amounts reclassified from accumulated other

comprehensive income .......................... — 481 481

Net increase (decrease) in other comprehensive

income ................................... 1,772 (1,116) 656

Balance as of December 31, 2013 ........................ $3,153 $ 422 $3,575

65