NetFlix 2013 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2013 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.fair value has been below cost basis, the financial condition of the issuer, the Company’s intent to sell, or

whether it would be more likely than not that the Company would be required to sell the investments before the

recovery of their amortized cost basis.

Streaming Content

The Company licenses rights to stream TV shows, movies and original content to members for unlimited

viewing. These licenses are for a fixed fee and specify license windows that generally range from six months to

five years. Payment terms may extend over the license window, or may require more up-front payments as is

typically the case for original content or content that is licensed in an earlier window through an output

arrangement.

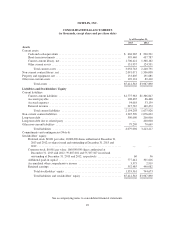

The Company capitalizes the fee per title and records a corresponding liability at the gross amount of

liabilities when the license period begins, the cost of the title is known and the title is accepted and available for

streaming. The portion available for streaming within one year is recognized as “Current content library” and the

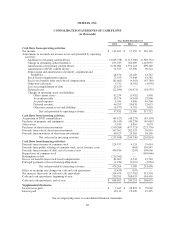

remaining portion as “Non-current content library”. The acquisition of streaming content license rights and the

changes in related liabilities, are classified within cash used in operating activities on the Consolidated

Statements of Cash Flows.

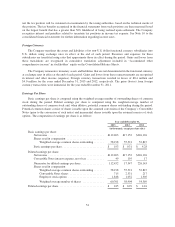

The Company amortizes the content library in “Cost of revenues” on a straight line or on an accelerated

basis, as appropriate:

• For content that does not premiere on the Netflix service (representing the vast majority of content), the

Company amortizes on a straight-line basis over the shorter of each title’s contractual window of

availability or estimated period of use, beginning with the month of first availability. The amortization

period typically ranges from six months to five years.

• For content that premieres on the Netflix service, the Company expects more upfront viewing due to the

additional merchandising and marketing efforts for this original content available only on Netflix. Hence,

the Company amortizes on an accelerated basis over the amortization period, which is the shorter of four

years or the license period, beginning with the month of first availability. If a subsequent season is added,

the amortization period is extended by a year.

• If the cost per title cannot be reasonably estimated, the license fee is not capitalized and costs are

expensed on a straight line basis over the license period. This typically occurs when the license

agreement does not specify the number of titles, the license fee per title or the windows of availability per

title.

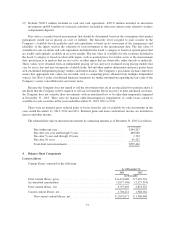

The content library is stated at the lower of unamortized cost or net realizable value. Streaming content

licenses (whether capitalized or not) are reviewed in aggregate at the geographic region level for impairment

when an event or change in circumstances indicates a change in the expected usefulness of the content. The level

of geographic aggregation is determined based on the streaming content rights which are generally specific to a

geographic region inclusive of several countries (such as Latin America). No material write down from

unamortized cost to a lower net realizable value was recorded in any of the periods presented.

DVD Content Library

The Company acquires DVD content for the purpose of renting such content to its members and earning

membership rental revenues, and, as such, the Company considers its direct purchase DVD library to be a

productive asset. Accordingly, the Company classifies its DVD library in “Non-current content library, net” on

the Consolidated Balance Sheets. The acquisition of DVD content library, net of changes in related liabilities, is

classified within cash used in investing activities on the Consolidated Statements of Cash Flows because the

DVD content library is considered a productive asset. Other companies in the in-home entertainment video

52