NetFlix 2013 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2013 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

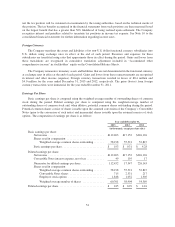

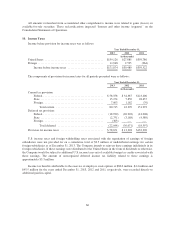

(2) Includes $290.3 million included in cash and cash equivalents, $457.8 million included in short-term

investments and $4.8 million of restricted cash that is included in other non-current assets related to workers

compensation deposits.

Fair value is a market-based measurement that should be determined based on the assumptions that market

participants would use in pricing an asset or liability. The hierarchy level assigned to each security in the

Company’s available-for-sale portfolio and cash equivalents is based on its assessment of the transparency and

reliability of the inputs used in the valuation of such instrument at the measurement date. The fair value of

available-for-sale securities and cash equivalents included in the Level 1 category is based on quoted prices that

are readily and regularly available in an active market. The fair value of available-for-sale securities included in

the Level 2 category is based on observable inputs, such as quoted prices for similar assets at the measurement

date; quoted prices in markets that are not active; or other inputs that are observable, either directly or indirectly.

These values were obtained from an independent pricing service and were evaluated using pricing models that

vary by asset class and may incorporate available trade, bid and other market information and price quotes from

well-established independent pricing vendors and broker-dealers. The Company’s procedures include controls to

ensure that appropriate fair values are recorded, such as comparing prices obtained from multiple independent

sources. See Note 5 to the consolidated financial statements for further information regarding the fair value of the

Company’s senior convertible notes and senior notes.

Because the Company does not intend to sell the investments that are in an unrealized loss position and it is

not likely that the Company will be required to sell any investments before recovery of their amortized cost basis,

the Company does not consider those investments with an unrealized loss to be other-than-temporarily impaired

at December 31, 2013. There were no material other-than-temporary impairments or credit losses related to

available-for-sale securities in the years ended December 31, 2013, 2012 or 2011.

There were no material gross realized gains or losses from the sale of available-for-sale investments in the

years ended December 31, 2013, 2012 and 2011. Realized gains and losses and interest income are included in

interest and other income.

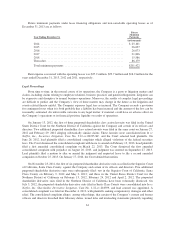

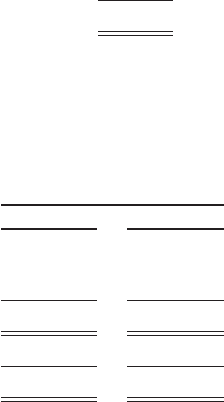

The estimated fair value of short-term investments by contractual maturity as of December 31, 2013 is as follows:

(in thousands)

Due within one year .............................................. $144,267

Due after one year and through 5 years ............................... 408,048

Due after 5 years and through 10 years ............................... 1,703

Due after 10 years ............................................... 41,422

Total short-term investments ....................................... $595,440

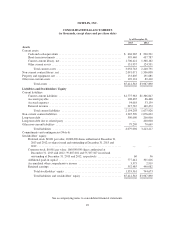

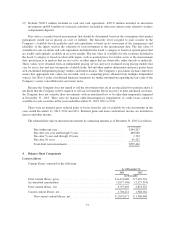

4. Balance Sheet Components

Content Library

Content library consisted of the following:

As of December 31,

2013 2012

(in thousands)

Total content library, gross .................................... $6,474,688 $ 5,001,524

Accumulated amortization .................................... (2,677,196) (2,127,354)

Total content library, net ..................................... 3,797,492 2,874,170

Current content library, net .................................... 1,706,421 1,368,162

Non-current content library, net ............................ $2,091,071 $ 1,506,008

57