NetFlix 2013 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2013 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

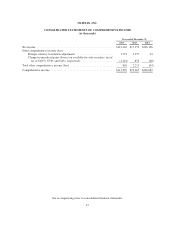

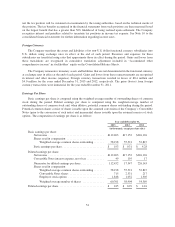

Employee stock options with exercise prices greater than the average market price of the common stock

were excluded from the diluted calculation as their inclusion would have been anti-dilutive. The following table

summarizes the potential common shares excluded from the diluted calculation:

Year ended December 31,

2013 2012 2011

(in thousands)

Employee stock options ........................................... 198 1,207 225

Stock-Based Compensation

The Company grants stock options to its employees on a monthly basis. The Company has elected to grant all

options as fully vested non-qualified stock options. As a result of immediate vesting, stock-based compensation

expense is fully recognized on the grant date, and no estimate is required for post-vesting option forfeitures. See

Note 8 to the consolidated financial statements for further information regarding stock-based compensation.

Stock Repurchases

To facilitate a stock repurchase program, shares are repurchased by the Company in the open market and are

accounted for when the transaction is settled. Shares held for future issuance are classified as Treasury stock.

Shares formally or constructively retired are deducted from common stock for par value and from additional

paid-in capital for the excess over par value. If additional paid-in capital has been exhausted, the excess over par

value is deducted from Retained earnings. Direct costs incurred to acquire the shares are included in the total cost

of the shares.

2. Reclassifications and Changes in Estimates

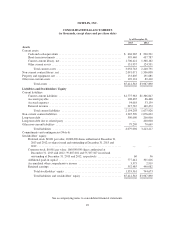

Certain prior year amounts have been reclassified to conform to the current year presentation in the

consolidated financial statements. Payroll and related expenses of $19.3 million and $21.4 million for the years

ended December 31, 2012 and 2011, respectively, associated with corporate marketing personnel, previously

classified in “Marketing” on the Consolidated Statements of Operations, have been reclassified as “General and

administrative.” Historically these costs were substantially recorded in the Domestic streaming segment and

impacted segment contribution profit. Management and the Company’s chief operating decision maker consider

such employee costs to be global corporate costs rather than marketing costs directly attributable to the segment

and as such are not indicative of any given segment’s performance. Accordingly, such costs have been

reclassified as “General and administrative” expenses which are not a component of contribution profit. There

was no impact to operating income in any year presented.

Prepaid content amounts are now included in Other current assets on both the Consolidated Balance Sheets

and the Consolidated Statements of Cash Flows as they are not material.

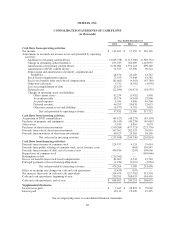

Certain prior year amounts in the Consolidated Statements of Cash Flows have been revised to correctly

present changes in accounts payable related to purchases of fixed assets. For the year ended December 31, 2012,

a $1.2 million increase in accounts payable has been reclassified from purchases of property and equipment in

“Net cash used in investing activities” to changes in accounts payable in “Net cash provided by operating

activities.” There was no impact to the Consolidated Statements of Operations or Consolidated Balance Sheets.

The Company had a change in estimate that is reflected in the consolidated financial statements for the year

ended December 31, 2013. When the Company started with original content, the Company did not have specific

data about viewing patterns over time for content that premieres on Netflix. Based on experience with other similar

television series and initial estimates of viewing patterns, the Company amortized this type of content on a straight-

line basis over the shorter of four years or the license period. If a subsequent season is added, the remaining

55