NetFlix 2013 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2013 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The $226.1 million decrease in our domestic DVD revenues was due to a 20% decrease in the average

number of paid memberships.

The $132.1 million decrease in domestic DVD cost of revenues was primarily due to a $63.2 million

decrease in content acquisition expenses and a $47.7 million decrease in content delivery expenses resulting from

a 21% decrease in the number of DVDs mailed to paying members. The decrease in shipments was driven by a

decline in the number of DVD memberships. Other costs, primarily those associated with content processing and

customer service center expenses, decreased $21.2 million primarily due to a decrease in hub operation expenses

resulting from the decline in DVD shipments.

Our Domestic DVD segment had a contribution margin of 48% for the year ended December 31, 2013, and

was relatively flat as compared to the year ended December 31, 2012.

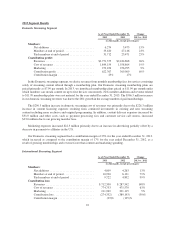

2012 Segment Results

Domestic Segments

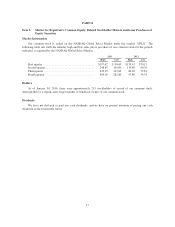

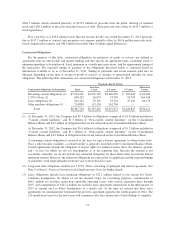

As of /Year Ended December 31, Change

2012 2011 2012 vs. 2011

(in thousands, except percentages)

Members:

Domestic Streaming

Members at end of period .................. 27,146 21,671 25%

Paid members at end of period .............. 25,471 20,153 26%

Domestic DVD

Members at end of period .................. 8,224 11,165 (26)%

Paid members at end of period .............. 8,049 11,039 (27)%

Unique Domestic

Net additions ............................ 4,973 4,894 2%

Members at end of period .................. 29,368 24,395 20%

Paid members at end of period .............. 27,613 22,858 21%

Contribution Profit:

Revenues ............................... $3,321,740 $3,121,727 6%

Cost of revenues ......................... 2,150,296 1,932,419 11%

Marketing .............................. 264,285 302,752 (13)%

Contribution profit ....................... 907,159 886,556 2%

Contribution margin ...................... 27% 28%

Prior to July 2011, in the U.S., our streaming and DVDs-by-mail operations were combined and members

could receive both streaming content and DVDs under a single “hybrid” plan. In July 2011, we introduced DVD

only plans and separated the combined plans, making it necessary for members who wish to receive both

streaming services and DVDs-by-mail to have two separate membership plans. As members were able to receive

both streaming and DVDs-by-mail under a single hybrid plan prior to the fourth quarter of 2011, it is

impracticable to allocate revenues and expenses to the Domestic streaming and Domestic DVD segments prior to

the fourth quarter of 2011.

The $200.0 million increase in our domestic revenues in 2012 as compared to 2011 was primarily due to the

15% growth in the domestic average number of unique paying members driven by new streaming memberships.

This increase was offset in part by an 8% decline in domestic average monthly revenue per unique paying

member, resulting from the decline in DVD memberships.

The $217.9 million increase in domestic cost of revenues in 2012 as compared to 2011 was primarily due to a

$397.7 million increase in content licensing expenses. This increase was primarily attributable to continued

investments in existing and new streaming content. Content delivery expenses decreased by $162.0 million primarily

24