NetFlix 2013 Annual Report Download - page 38

Download and view the complete annual report

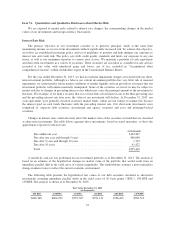

Please find page 38 of the 2013 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Based on investment positions as of December 31, 2013, a hypothetical 100 basis point increase in interest

rates across all maturities would result in an $8.6 million incremental decline in the fair market value of the

portfolio. As of December 31, 2012, a similar 100 basis point increase in the yield curve would have resulted in a

$1.5 million incremental decline in the fair market value of the portfolio. Such losses would only be realized if

the Company sold the investments prior to maturity.

Foreign Currency Risk

We have foreign currency risk related to our revenues and operating expenses denominated in currencies

other than the U.S. dollar, primarily the Euro, the British Pound, the Canadian Dollar, and the Brazilian Real.

Accordingly, changes in exchange rates may negatively affect our revenue and net income as expressed in U.S.

dollars. We also have foreign currency risk related to foreign currency transactions and monetary assets and

liabilities, including intercompany balances denominated in currencies that are not the functional currency. We

have experienced and will continue to experience fluctuations in our net income as a result of gains (losses) on

these foreign currency transactions and the remeasurement of monetary assets and liabilities. To date, the impacts

of foreign currency exchange rate changes on our revenues and net income have not been material. The volatility

of exchange rates depends on many factors that we cannot forecast with reliable accuracy.

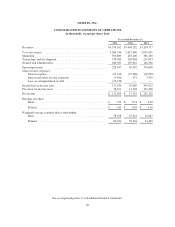

Item 8. Financial Statements and Supplementary Data

The consolidated financial statements and accompanying notes listed in Part IV, Item 15(a)(1) of this

Annual Report on Form 10-K are included immediately following Part IV hereof and incorporated by reference

herein.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

None.

Item 9A. Controls and Procedures

(a) Evaluation of Disclosure Controls and Procedures

Our management, with the participation of our Chief Executive Officer and Chief Financial Officer,

evaluated the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and

15d-15(e) under the Securities Exchange Act of 1934, as amended) as of the end of the period covered by this

Annual Report on Form 10-K. Based on that evaluation, our Chief Executive Officer and Chief Financial Officer

concluded that our disclosure controls and procedures as of the end of the period covered by this Annual Report

on Form 10-K were effective in providing reasonable assurance that information required to be disclosed by us in

reports that we file or submit under the Securities Exchange Act of 1934, as amended, is recorded, processed,

summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules

and forms, and that such information is accumulated and communicated to our management, including our Chief

Executive Officer and Chief Financial Officer, as appropriate, to allow timely decisions regarding required

disclosures.

Our management, including our Chief Executive Officer and Chief Financial Officer, does not expect that

our disclosure controls and procedures or our internal controls will prevent all error and all fraud. A control

system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the

objectives of the control system are met. Further, the design of a control system must reflect the fact that there

are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the

inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all

control issues and instances of fraud, if any, within Netflix have been detected.

36