NetFlix 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 NetFlix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

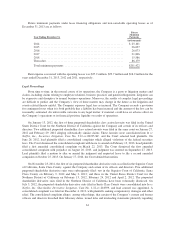

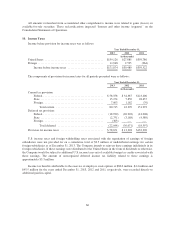

were issued at par and were senior unsecured obligations of the Company. Interest was payable semi-annually at

a rate of 8.50% per annum on May 15 and November 15 of each year, commencing on May 15, 2010.

The 8.50% Notes were repayable in whole or in part upon the occurrence of a change of control, at the option of

the holders, at a purchase price in cash equal to 101% of the principal plus accrued interest. The Company could

redeem the 8.50% Notes prior to November 15, 2013 in whole or in part at a redemption price of 100% of the

principal plus accrued interest, plus a “make-whole” premium.

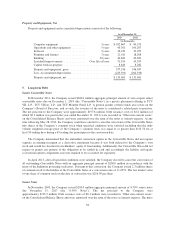

In February 2013, the Company issued $500.0 million aggregate principal amount of 5.375% senior notes

due 2021 (the “5.375% Notes”). The 5.375% Notes were issued at par and are senior unsecured obligations of the

Company. Interest is payable semi-annually at a rate of 5.375% per annum on February 1 and August 1 of each

year, commencing on August 1, 2013. The 5.375% Notes are repayable in whole or in part upon the occurrence

of a change of control, at the option of the holders, at a purchase price in cash equal to 101% of the principal plus

accrued interest. The Company may redeem the 5.375% Notes prior to maturity in whole or in part at an amount

equal to the principal amount thereof plus accrued and unpaid interest plus a make-whole payment equivalent to

the present value of the remaining interest payments through maturity.

The 5.375% Notes include, among other terms and conditions, limitations on the Company’s ability to

create, incur or allow certain liens; enter into sale and lease-back transactions; create, assume, incur or guarantee

additional indebtedness of the Company’s subsidiaries; and consolidate or merge with, or convey, transfer or

lease all or substantially all of the Company’s and its subsidiaries assets, to another person. At December 31,

2013 the Company was in compliance with these covenants.

In the first quarter of 2013, the Company used $224.5 million of the net proceeds of the 5.375% Notes to

redeem the outstanding $200.0 million aggregate principal amount of 8.50% Notes and pursuant to the make-whole

provision in the Indenture governing the 8.50% Notes, paid a $19.4 million premium and $5.1 million of accrued

and unpaid interest. The Company recognized a loss on extinguishment of debt of $25.1 million related to

redemption of the 8.50% Notes which included the write off of unamortized debt issuance costs of $4.2 million.

Based on quoted market prices in less active markets (a Level 2 input for this financial instrument), the fair

value of the 5.375% Notes as of December 31, 2013 was approximately $506.3 million.

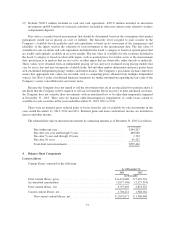

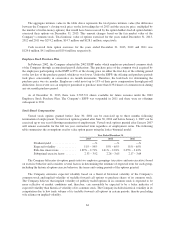

6. Commitments and Contingencies

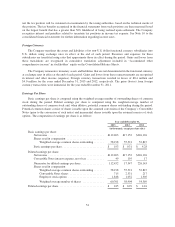

Streaming Content

At December 31, 2013, the Company had $7.3 billion of obligations comprised of $1.8 billion included in

“Current content liabilities” and $1.3 billion of “Non-current content liabilities” on the Consolidated Balance

Sheets and $4.2 billion of obligations that are not reflected on the Consolidated Balance Sheet.

At December 31, 2012, the Company had $5.6 billion of obligations comprised of $1.3 billion included in

“Current content liabilities” and $1.1 billion of “Non-current content liabilities” on the Consolidated Balance

Sheets and $3.2 billion of obligations that are not reflected on the Consolidated Balance Sheet.

The expected timing of payments for these streaming content obligations is as follows:

As of December 31,

2013 2012

(in thousands)

Less than one year .................................... $2,972,325 $2,299,562

Due after one year and through 3 years .................... 3,266,907 2,715,294

Due after 3 years and through 5 years ..................... 929,645 540,346

Due after 5 years ..................................... 83,284 78,483

Total streaming content obligations ...................... $7,252,161 $5,633,685

59